Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Whole Life Insurance: The Policy That Keeps on Giving

Unlock the secrets of whole life insurance—discover why this policy is your lifelong financial ally and keeps on giving!

Understanding Whole Life Insurance: Benefits and Features Explained

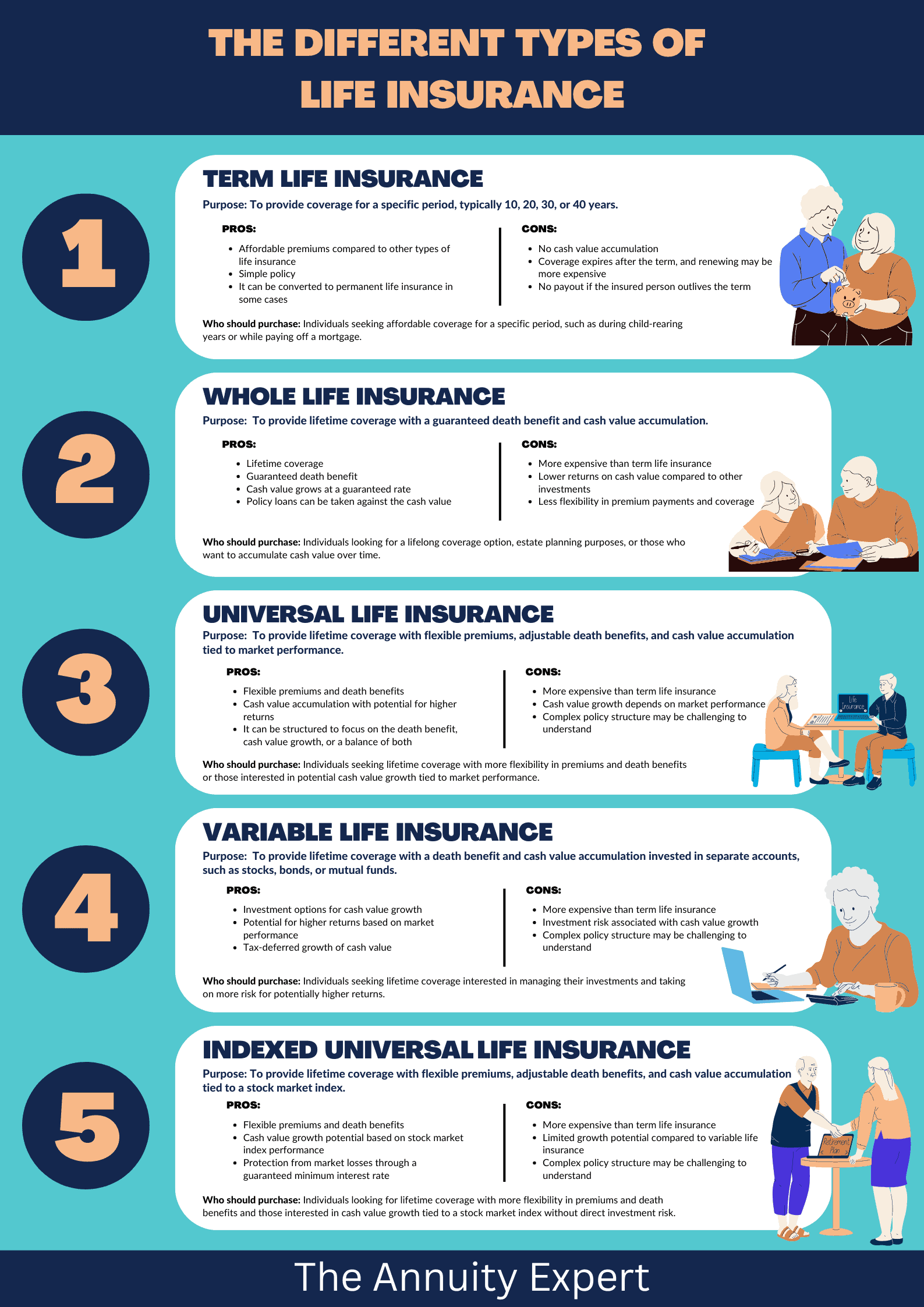

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as the premiums are paid. One of the primary benefits of whole life insurance is its ability to accumulate cash value over time, which can be borrowed against or withdrawn. This feature can serve as a financial resource during the policyholder's lifetime. Additionally, whole life policies typically come with a guaranteed death benefit, providing peace of mind to the insured and their beneficiaries. The predictability of premiums that remain fixed throughout the policy's duration also makes budgeting easier for policyholders.

Among the notable features of whole life insurance are its inherent stability and protection against market volatility. Since the cash value grows at a guaranteed rate set by the insurer, it provides a reliable savings component. Policyholders can also benefit from participating in dividends if their policy is a participating whole life policy, further enhancing returns over time. In summary, whole life insurance offers a unique blend of protection, savings, and financial growth that can be an essential component of a comprehensive financial plan.

Is Whole Life Insurance the Right Choice for You? Key Considerations

When considering whether whole life insurance is the right choice for you, it's essential to evaluate your long-term financial goals and needs. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection with a cash value component. This means that part of your premiums contributes to a savings component that grows over time. Before making a decision, ask yourself the following questions:

- What are my financial goals in the long run?

- Do I want lifelong coverage or just protection for a certain period?

- How much can I afford to pay in premiums?

Another critical consideration is your current financial situation and how whole life insurance fits into your overall financial plan. This type of policy tends to have higher premiums than term life insurance, making it important to assess whether it aligns with your budget. Additionally, the cash value accumulation can serve as a potential source of funds for emergencies or investment opportunities. It’s advisable to weigh the benefits against the costs and consider consulting a financial advisor to determine if whole life insurance is a wise investment for your future.

How Whole Life Insurance Can Provide Financial Security for Your Loved Ones

Whole life insurance serves as a powerful tool for ensuring the financial security of your loved ones in the event of an unforeseen tragedy. Unlike term insurance, which provides coverage for a specified period, whole life insurance offers lifelong protection and has a cash value component that grows over time. This means that, not only do your beneficiaries receive a guaranteed death benefit, but you can also accumulate savings through the cash value that can be accessed during your lifetime. This dual benefit allows you to plan more strategically for both the present and the future.

When considering how whole life insurance can enhance your family's financial stability, it's essential to recognize the peace of mind it provides. With a whole life policy, you can confidently know that your loved ones will not be burdened with financial stress during a difficult time. The benefits of having a whole life policy include:

- Guaranteed death benefits that never decrease, providing lasting security.

- Tax-deferred cash value growth, allowing you to build savings over time.

- The ability to borrow against the cash value, offering a safety net in emergencies.