Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Offshore Banks: Your Secret Financial Playground

Discover the hidden world of offshore banks and unlock secret financial strategies to grow your wealth beyond borders!

Understanding Offshore Banking: The Benefits and Risks Explained

Understanding offshore banking can be a crucial step for individuals and businesses looking to diversify their financial portfolios. Offshore banking offers several advantages, including tax benefits, enhanced privacy, and greater accessibility to international investment opportunities. By placing funds in offshore accounts, clients can potentially reduce their tax liabilities and safeguard their assets from political instability or economic downturns in their home countries. Furthermore, many offshore banks provide robust security measures and personalized banking services tailored to meet the unique needs of their clients.

However, it is essential to recognize the risks associated with offshore banking as well. Compliance with international laws and regulations is critical, and failure to adhere may result in severe penalties. Additionally, while offshore accounts offer privacy, this can sometimes lead to misconceptions about legality, potentially attracting unwanted scrutiny from tax authorities. Therefore, it's vital for anyone considering offshore banking to conduct thorough research and consult with financial advisors to understand the full scope of benefits and risks.

Is Offshore Banking Right for You? Key Considerations and Insights

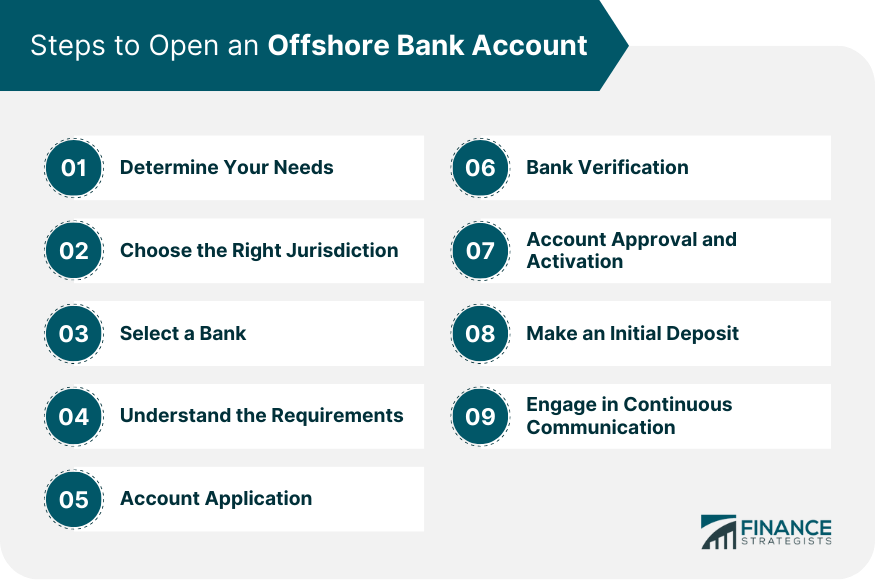

Offshore banking can be an attractive option for individuals seeking financial privacy, asset protection, and potential tax benefits. However, before diving into this financial strategy, it's crucial to consider a few key factors. First, understanding the legal implications of offshore banking is essential, as different countries have varied regulations. Compliance with your home country's tax laws is critical to avoid penalties. Additionally, evaluating your financial goals and understanding the costs associated with maintaining an offshore bank account can help you determine whether this option aligns with your financial strategy.

Another important consideration is the level of risk involved in offshore banking. While there are legitimate reasons for opening an offshore account, the potential for fraud or mismanagement exists, especially in jurisdictions with less regulation. Researching the reputation of the bank, understanding the security measures in place, and knowing your rights as an account holder are all essential steps. Speaking with a qualified financial advisor can also provide valuable insights tailored to your personal situation, helping you decide if offshore banking is the right choice for you.

Top 5 Myths About Offshore Banks Debunked

When it comes to offshore banks, misconceptions abound that can mislead potential clients. One of the most prevalent myths is that offshore banking is meant exclusively for the wealthy elite. In reality, offshore accounts are accessible to a wider audience than many believe, offering various options for individuals seeking to enhance their financial privacy or diversify their investments. Offshore banking can provide benefits such as asset protection, tax optimization, and even access to international investment opportunities.

Another common myth is that offshore banks encourage tax evasion. This is not necessarily true; while some individuals may misuse offshore accounts for illegal purposes, the vast majority are perfectly legal and compliant with tax laws. Financial regulations require individuals to report offshore accounts and pay any applicable taxes, showcasing that transparency is crucial. Understanding the legal implications of maintaining an offshore bank account is essential for anyone considering this financial option.