Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Insurance on a Dime: How to Save Big Without Sacrificing Coverage

Discover savvy tips to slash insurance costs without sacrificing coverage. Save big and protect what matters most!

Top 5 Tips to Cut Your Insurance Costs Without Compromising Coverage

Cutting your insurance costs doesn't mean you have to sacrifice important coverage. Here are the top 5 tips to help you save money while maintaining the protection you need:

- Review Your Policies: Regularly assess your coverage options and compare them to your current needs. You may find that some areas have over-insurance, which can be reduced without compromising your essential coverage.

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. This can lead to significant savings while keeping your coverage intact.

- Increase Your Deductible: Opting for a higher deductible can lower your premiums. Just ensure you can afford the deductible in case of a claim.

- Maintain a Good Credit Score: A better credit score often correlates with lower insurance premiums. Pay your bills on time and keep your credit utilization low.

- Shop Around: Don't settle for the first insurance provider you encounter. Regularly compare quotes from different insurers to identify more competitive rates without sacrificing coverage.

Understanding Your Policy: What to Look for to Maximize Savings

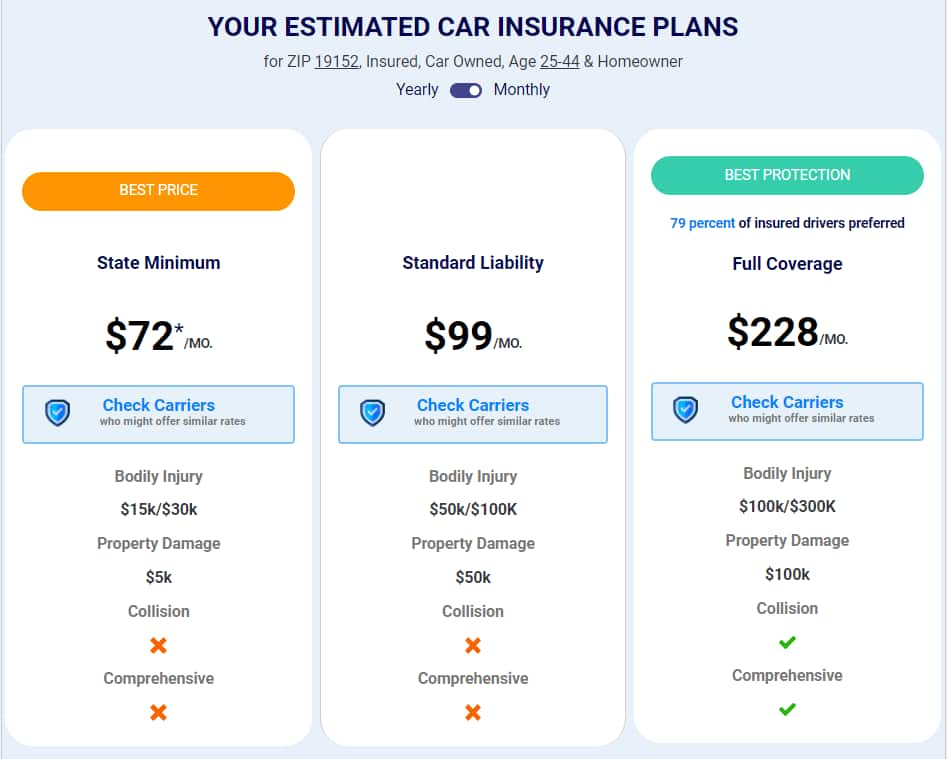

Understanding your policy is crucial for maximizing savings on your insurance. Begin by carefully reviewing the coverage limits and deductibles outlined in your policy. A higher deductible can lower your premium, but it also means you'll pay more out of pocket in the event of a claim. Additionally, assess the types of coverage provided—such as liability, collision, or comprehensive— to ensure you’re not overpaying for services you don’t need. Comparing offers from multiple insurers can also reveal opportunities for significant savings.

Another essential factor to consider is the discounts available through your policy. Many insurers offer reductions for bundling multiple policies, maintaining a claims-free record, or participating in safe driving courses. Review your insurer's policies on discounts and ask about any that you might qualify for. Keeping your personal information up to date with your insurer can also help you find additional savings, as changes in your situation—like moving to a safer neighborhood—may qualify you for lower rates.

Are You Overpaying? Common Mistakes to Avoid in Insurance Shopping

When it comes to insurance shopping, many consumers unknowingly make mistakes that can lead to overpaying for their coverage. One common error is failing to compare policies from multiple providers. Each insurer may offer different rates for similar coverage, so obtaining quotes from various companies is essential. Additionally, don't overlook the importance of reviewing the policy details. A lower premium might come with higher deductibles or reduced coverage limits, which could end up costing you more in the long run.

Another mistake to avoid is not taking advantage of discounts or bundling options. Many insurance companies offer discounts for things like safe driving records, home security systems, or bundling multiple policies such as auto and home insurance. It’s important to ask about these potential savings when gathering quotes. Lastly, be wary of assuming that your current policy is still the best option. Regularly reviewing your coverage and comparing it against the market can help ensure that you're not overpaying for your insurance premiums.