Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Disability Insurance: Your Safety Net in a World Full of Uncertainty

Discover how disability insurance can safeguard your future and provide peace of mind in uncertain times. Don't leave your safety to chance!

Understanding Disability Insurance: Why It's Essential for Your Financial Security

Understanding Disability Insurance is crucial for anyone looking to secure their financial future. This type of insurance provides income replacement if you become unable to work due to a disability, whether temporary or permanent. According to estimates, around one in four individuals may experience a disability before reaching retirement age. Thus, having a robust plan in place ensures that you and your loved ones are protected against unexpected financial hardships. Moreover, disability insurance not only covers your living expenses but can also help pay for medical bills and other essential costs, making it an indispensable part of a sound financial strategy.

Investing in disability insurance represents a proactive step towards safeguarding your financial security. When evaluating policies, consider factors such as coverage amount, waiting periods, and the duration of benefits. You may encounter different types of plans, including short-term and long-term disability insurance. Each offers distinct advantages depending on your individual circumstances. It's essential to take the time to assess your needs and consult with a financial advisor to select the best option for you. Ultimately, having this coverage not only provides peace of mind but also reinforces a solid foundation for your overall financial well-being.

Top 5 Myths About Disability Insurance Debunked

Disability insurance is often misunderstood, leading to several common myths that can hinder individuals from securing the right coverage. One prevalent myth is that disability insurance is only for workers in hazardous jobs. In reality, anyone can become disabled due to illness or injury, regardless of their occupation. This myth can prevent many from considering disability insurance as a vital part of their financial planning.

Another misconception is that disability insurance is too expensive and not worth the investment. While it’s true that the premium may seem daunting, the potential benefits far outweigh the costs. In fact, disability insurance can replace a significant portion of your income if you can’t work, providing essential financial support during difficult times. It's important to weigh the long-term financial security it offers against the upfront costs.

How to Choose the Right Disability Insurance Plan for Your Needs

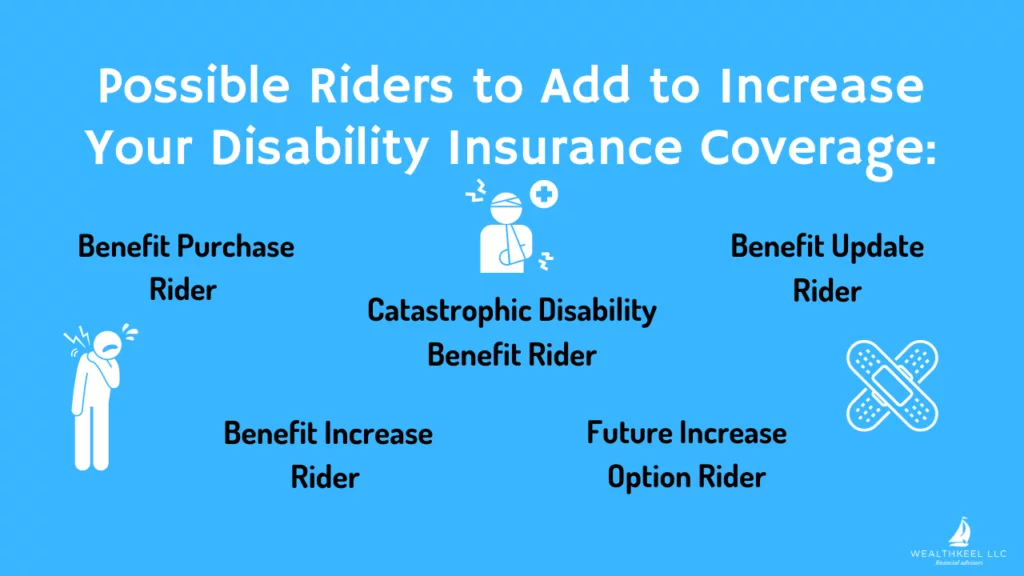

Choosing the right disability insurance plan is essential for securing your financial future in the event of an unexpected illness or injury. Start by evaluating your personal needs, including your current financial obligations and income. Consider factors such as your monthly expenses, savings, and the duration for which you may need coverage. It's also important to understand the different types of policies available: short-term and long-term disability insurance. Each offers unique benefits, so assess which type aligns best with your circumstances.

Next, examine the policy details closely. Look for key features such as the elimination period, which is the amount of time you must wait before benefits kick in, and the benefit period, which is how long you will receive payments. It's crucial to read the fine print and understand any exclusions or limitations that could affect your coverage. Lastly, consider working with a qualified insurance agent who can help you navigate the options and tailor a plan to fit your specific needs.