Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Banking on Change: How to Navigate the Future of Finance

Unlock the secrets to financial success! Discover how to thrive in the evolving world of finance with our expert insights and tips.

The Rise of Digital Banking: Trends Shaping the Future

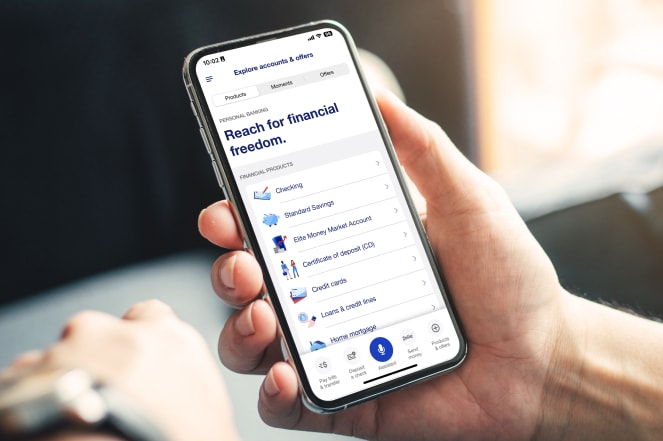

The financial landscape is significantly transforming with the rise of digital banking, driven by technological advancements and changing consumer behavior. One of the most notable trends is the increased adoption of mobile banking applications, which offer users convenience and accessibility like never before. According to recent surveys, over 75% of consumers prefer managing their finances through their smartphones, prompting traditional banks to innovate their services to meet these new demands. As digital wallets and contactless payments gain traction, the push for a cashless society is becoming more apparent, influencing banks to enhance their digital offerings.

Furthermore, the integration of artificial intelligence (AI) and machine learning in banking is reshaping customer interactions and operational efficiency. AI-powered chatbots provide 24/7 customer service, reducing wait times and improving user experience. Additionally, fintech companies are leveraging these technologies to offer personalized financial solutions, setting new standards in the industry. Overall, these trends indicate that the future of banking is poised to be more user-centric, streamlined, and innovative, marking a definitive shift in how consumers manage their finances.

Navigating Cryptocurrency: A Beginner's Guide to Investment

Cryptocurrency has emerged as a revolutionary asset class, attracting novice and experienced investors alike. For beginners looking to invest in digital currencies, it's essential to start with a solid understanding of the fundamentals. Begin by familiarizing yourself with key concepts such as blockchain technology, wallets, and exchanges. Understanding how cryptocurrencies function can help you make informed decisions. Here's a quick list of steps to get you started:

- Research different cryptocurrencies and their use cases.

- Choose a reputable cryptocurrency exchange.

- Create a secure wallet to store your assets.

Once you've grasped the basics, it's crucial to develop a strategy tailored to your financial goals. Consider adopting a diversified portfolio to mitigate risks associated with cryptocurrency investment. Remember, the market is volatile, and prices can fluctuate dramatically. It's wise to invest only what you can afford to lose and to regularly update your knowledge as the industry evolves. Additionally, engage with communities online to share insights and learn from experienced traders. Staying informed will boost your confidence as you navigate the exciting world of cryptocurrency.

What Does the Future Hold for Traditional Banks in a Digital World?

As we move further into a digital world, traditional banks face an unprecedented shift in their operational frameworks and customer engagement strategies. The rise of fintech companies has challenged these longstanding institutions to innovate or risk obsolescence. Digital transformation is no longer optional; it is a necessity. Banks must leverage technology to enhance their service offerings, streamline processes, and improve customer experiences. This could involve adopting artificial intelligence for personalized financial advice or using blockchain for secure, transparent transactions.

Moreover, the future landscape will demand that traditional banks focus on hybrid models that combine in-person services with digital accessibility. As consumers increasingly prefer mobile banking apps and online services, banks will need to invest in their digital interfaces and cybersecurity measures to protect customer data. With rising competition from digital-only banks, established institutions must not only retain customer loyalty but also attract new users by showcasing their adaptability to modern banking practices. Innovation and customer-centric strategies will be pivotal in determining the survival of traditional banks in this rapidly changing environment.