Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Bargain Coverage: Saving Big on Insurance Without the Fuss

Discover how to save big on insurance hassle-free! Unlock the secrets to bargain coverage and watch your savings grow today!

Top 5 Tips for Finding Affordable Insurance Without Compromising Coverage

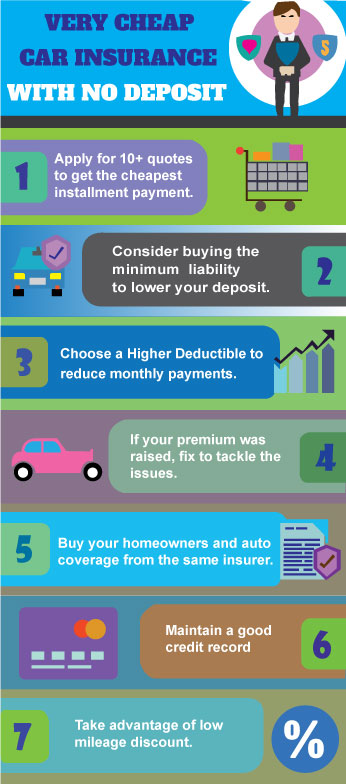

Finding affordable insurance without compromising coverage can seem daunting, but it is entirely possible with the right approach. One of the first steps is to compare quotes from multiple providers. Utilizing online comparison tools can help streamline this process, allowing you to evaluate different policies side by side. Additionally, consider bundling services, such as auto and home insurance, which often leads to discounts and helps maximize your coverage while minimizing costs.

Another crucial tip is to review your policy options carefully. Look for various rates and coverages to identify what fits your needs best. Don't hesitate to ask agents about discounts for things like safe driving records or maintaining a good credit score. Lastly, consider increasing your deductible; a higher deductible can lower your premium, but make sure you have enough savings to cover it in case of a claim. By following these tips, you can secure affordable insurance that offers the coverage you need.

How to Compare Insurance Policies: A Step-by-Step Guide

When comparing insurance policies, it’s important to start by determining your specific needs. Begin by making a list of the coverage types you require, such as health, auto, home, or life insurance. Next, gather quotes from multiple insurers to assess the premiums you’ll need to pay. Consider using an organized approach by creating a comparison chart, where you can easily visualize key details like coverage limits, deductibles, and exclusions. This will help you identify which policies provide the best value based on your requirements.

Once you have gathered all necessary information, focus on evaluating the benefits and drawbacks of each policy. Pay close attention to the fine print; understanding the terms and conditions can prevent future surprises. It's also useful to check customer reviews and insuer ratings to gauge the level of service provided. Lastly, don’t hesitate to reach out to insurance agents for clarifications on any policies you find appealing. By following these steps, you can confidently make an informed decision on your insurance coverage.

What to Look for in Budget-Friendly Insurance Plans?

When searching for budget-friendly insurance plans, it's essential to prioritize coverage that fits your specific needs without breaking the bank. Start by evaluating the types of coverage required—whether it's health, auto, home, or life insurance. A thorough assessment of your personal circumstances will help you determine which options are necessary. Additionally, consider deductibles and premium amounts: while lower premiums might seem attractive, higher deductibles can lead to unexpected out-of-pocket costs. Use comparison tools to assess multiple providers, narrowing down those that offer competitive pricing without sacrificing essential coverage.

Another crucial factor in finding budget-friendly insurance plans is the reputation and customer service of the insurance provider. Look for customer reviews and ratings on claim satisfaction to gauge reliability. It's also advisable to inquire about discounts that may apply to you, such as bundling multiple policies or demonstrating safe driving habits. Finally, take the time to dissect the policy terms and conditions. Understanding the fine print can prevent future surprises, ensuring that your chosen plan delivers quality coverage at an affordable rate.