Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Blockchain: The Invisible Revolution Shaping Our Future

Discover how blockchain is revolutionizing our world and shaping a future of transparency, security, and innovation. Join the invisible revolution!

Understanding Blockchain: How This Technology is Transforming Industries

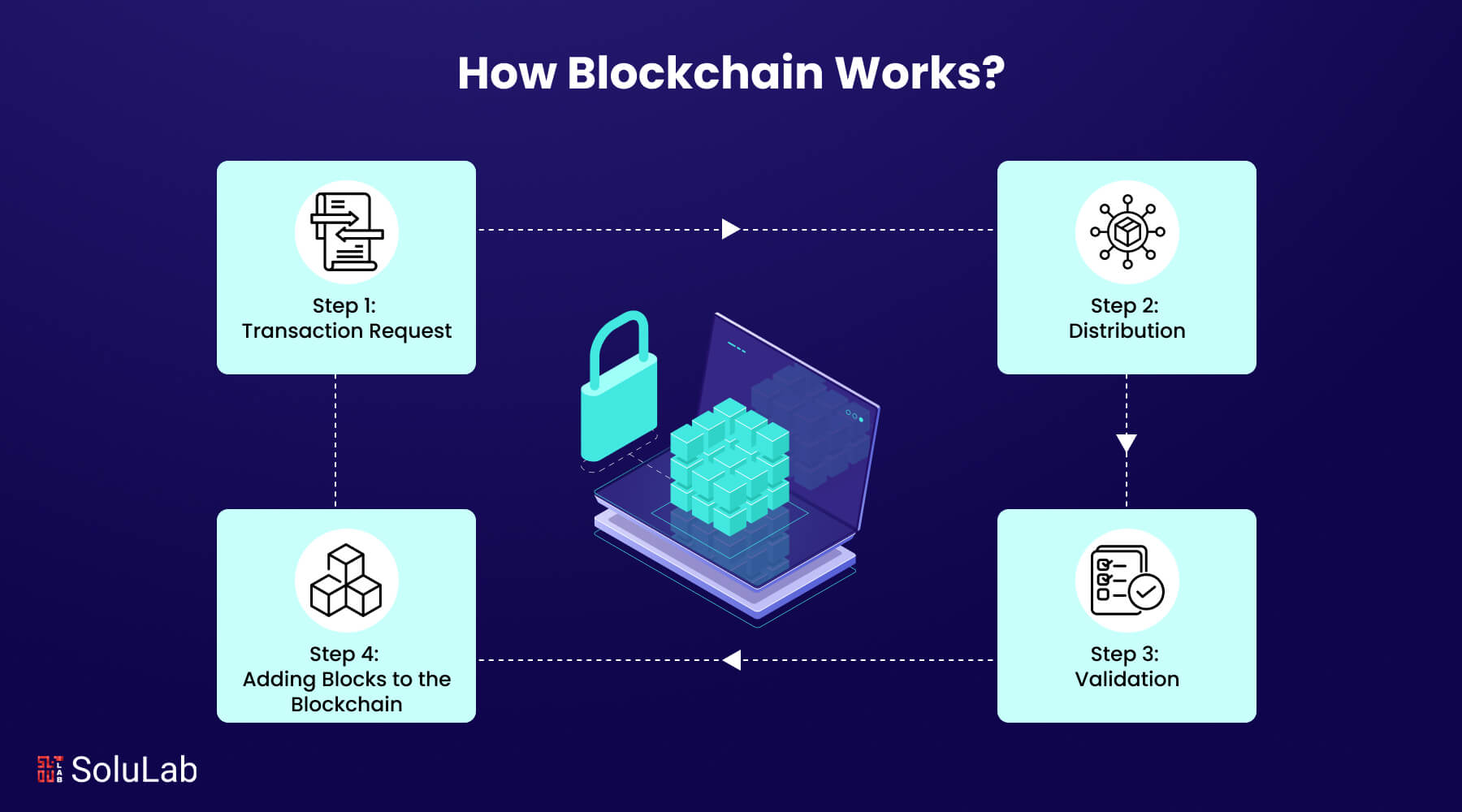

Understanding Blockchain is essential in today's digital landscape, as it represents a revolutionary shift in how industries manage data and transactions. This decentralized technology enables secure, transparent, and tamper-proof record-keeping, which is transforming traditional business models. For instance, in the financial sector, blockchain eliminates the need for intermediaries, allowing for faster and cheaper cross-border payments. As a result, businesses can significantly reduce operational costs and enhance transaction efficiency, making it an appealing option for organizations looking to innovate.

Moreover, the impact of blockchain technology extends beyond finance. Sectors such as supply chain management, healthcare, and real estate are leveraging this technology to improve transparency and accountability. In supply chains, for example, blockchain facilitates real-time tracking of products, ensuring authenticity and minimizing fraud. This leads to increased consumer trust and a more streamlined process. As businesses increasingly adopt blockchain, understanding its capabilities will be crucial for staying competitive in an ever-evolving marketplace.

The Future of Finance: How Blockchain is Redefining Transactions

The advent of blockchain technology is rapidly transforming the landscape of financial transactions. Unlike traditional systems that rely on central authorities, blockchain operates as a decentralized ledger, providing transparency and security. This shift allows for peer-to-peer transactions that eliminate intermediaries, leading to reduced transaction costs and enhanced efficiency. With its ability to facilitate instant settlements and smart contracts, blockchain is redefining the speed and reliability of financial operations.

As we look towards the future of finance, the implications of blockchain extend beyond mere transactions. Key industries, such as banking and insurance, are beginning to integrate blockchain solutions to streamline their processes and improve customer experiences. Moreover, the rise of decentralized finance (DeFi) is challenging conventional banking models, empowering individuals to manage their finances more autonomously. The undeniable impact of blockchain on the financial sector suggests that we are only scratching the surface of its potential.

5 Common Myths About Blockchain Debunked

As blockchain technology continues to gain traction in various industries, misconceptions about it also persist. One of the most common myths is that blockchain is synonymous with cryptocurrencies. While it is true that blockchain is the underlying technology for cryptocurrencies like Bitcoin and Ethereum, its applications extend far beyond digital currencies. Blockchain can enhance supply chain management, improve voting systems, and enable secure data sharing across different sectors, showcasing its versatility.

Another prevalent myth is that blockchain guarantees absolute privacy and anonymity. In reality, while blockchain transactions can provide a level of pseudonymity, the transparency of the technology means that all transactions are recorded on a public ledger. This means that with the right tools and knowledge, it is possible to trace transactions back to their origins. Therefore, users should not rely on blockchain for complete anonymity and should consider additional privacy measures when needed.