Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Disability Insurance: The Safety Net You Didn't Know You Needed

Discover why disability insurance is the essential safety net you never knew you needed. Protect your future today!

Understanding the Basics: What is Disability Insurance and Why You Need It

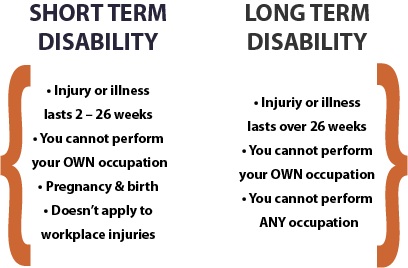

Disability insurance is a type of insurance designed to provide protection to individuals in the event that they become unable to work due to a disability caused by illness, injury, or other medical conditions. This coverage typically replaces a portion of the policyholder's income, ensuring that they can continue to meet monthly expenses such as rent or mortgage payments, utilities, and other essential obligations. When purchasing a policy, it's crucial to understand the different types available, including short-term and long-term disability insurance, as each serves unique needs and circumstances.

The necessity of having disability insurance cannot be overstated, particularly in an unpredictable world. According to statistics, a significant percentage of individuals will experience a disability during their working years, which can lead to financial strain without an adequate support system in place. By investing in disability insurance, you not only safeguard your income but also provide yourself with peace of mind, knowing that you have a financial safety net in case of unforeseen challenges. In essence, this type of insurance acts as a critical component of a comprehensive financial plan.

Top 5 Myths About Disability Insurance Debunked

When it comes to disability insurance, there are numerous myths that can lead to misconceptions about its importance and functionality. One common myth is that disability insurance is only for people in physically demanding jobs. In reality, anyone can become disabled, whether from a chronic illness, accident, or mental health issues. It’s crucial to understand that disabilities don’t discriminate based on profession; thus, everyone should consider the benefits of having this safety net in place.

Another prevalent myth is that disability insurance is too expensive and not worth the investment. While premium costs can vary, many policies are actually quite affordable, especially considering the potential financial devastation that can arise from an unexpected disability. Moreover, the **peace of mind** it provides knowing that you can maintain your income stream during a difficult time is invaluable. Debunking these myths is essential in helping individuals recognize the significance of disability insurance in securing their financial future.

How to Choose the Right Disability Insurance Policy for Your Needs

Choosing the right disability insurance policy is crucial for safeguarding your financial future in case of an unexpected illness or injury. Start by evaluating your individual needs, including your current income, expenses, and any existing savings. This assessment will help you determine the level of coverage you require. Additionally, consider factors such as the waiting period before benefits begin and the duration of those benefits. Making a list of necessary features can aid you in narrowing down your options.

Once you've identified your needs, compare different policies from various insurers. Pay attention to key elements such as premium costs, benefit caps, and whether the policy covers partial or total disability. It's also wise to read customer reviews and seek recommendations from professionals in the field. By taking the time to conduct thorough research, you'll be better equipped to choose a policy that not only fits your budget but also provides adequate protection for your unique situations.