Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

The Insurance Maze: How to Navigate Your Way to Savings

Unlock the secrets to insurance savings! Discover expert tips and tricks to navigate the maze and keep your hard-earned money.

Understanding the Basics: What You Need to Know About Insurance Policies

Understanding the basics of insurance policies is essential for making informed decisions about your coverage needs. An insurance policy is a contract between the policyholder and the insurance company that outlines the terms, conditions, and coverage limits of the insurance provided. This contract typically includes various essential elements, such as premium (the amount you pay for coverage), deductibles (the amount you pay out of pocket before coverage kicks in), and coverage limits (the maximum amount the insurer will pay for a covered loss). It's crucial to read and comprehend these terms to ensure you choose a policy that suits your financial and personal needs.

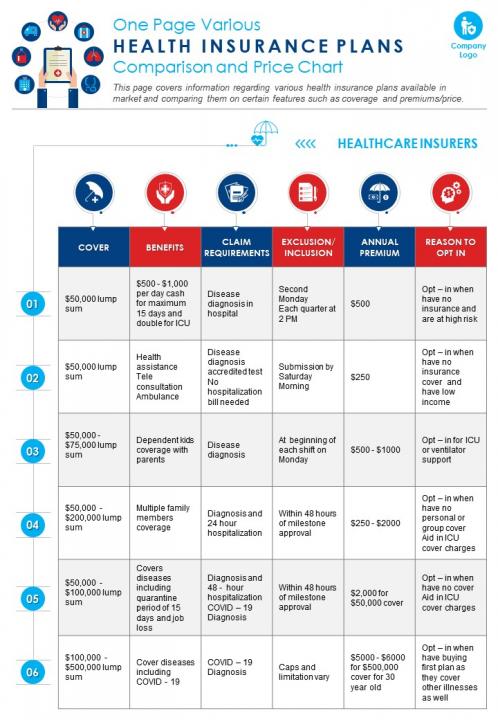

When selecting an insurance policy, it is important to assess your individual circumstances and consider factors like coverage types, such as:

- Health insurance

- Auto insurance

- Homeowners insurance

- Life insurance

Each type of coverage addresses different risks and needs. Furthermore, you should compare several policies to evaluate premiums, coverage limits, and exclusions. Always ask questions and seek clarification on any terms that seem unclear, as having a solid understanding of your insurance policy can protect you from unexpected financial burdens in the future.

Top 5 Tips for Finding the Best Insurance Rates

Finding the best insurance rates requires a combination of research and strategy. Here are Top 5 Tips to help you secure the most competitive rates:

- Compare Multiple Quotes: Don't settle for the first insurance policy you come across. Utilize online comparison tools or consult insurance agents to gather quotes from different providers, as rates can vary significantly.

- Understand Coverage Needs: Assess your coverage requirements before requesting quotes. Understanding what you need protects you from overpaying for unnecessary coverage.

Moreover, it's essential to keep certain factors in mind when shopping for insurance:

- Maintain a Good Credit Score: Many insurers consider credit scores when determining rates. By improving your credit, you could potentially lower your premiums.

- Ask About Discounts: Inquire about available discounts, such as bundling multiple policies, safe driver discounts, or loyalty rewards, as these can significantly reduce your overall costs.

- Review Annually: Insurance needs can change, so reviewing your policies every year ensures you are still getting the best rates and coverage.

Is Bundling Insurance the Key to Unlocking Savings?

When it comes to managing your finances, bundling insurance can be a game changer. This practice typically involves purchasing multiple types of insurance policies, such as auto, home, and life insurance, from a single provider. By opting for a bundled policy, consumers often enjoy significant discounts compared to buying individual policies separately. For instance, clients may save anywhere from 10% to 25% on their premiums, making it a smart financial choice for those looking to maximize their savings. Additionally, bundling simplifies the management of your policies, as you’ll have one provider for billing and customer service, streamlining the process significantly.

It's essential to evaluate the specific savings that bundling can offer, as these benefits can vary between insurance companies. Before making a decision, consider the following factors:

- Coverage Needs: Assess what types of coverage you need and ensure the bundled policies adequately meet those needs.

- Provider Reputation: Research the insurance provider to ensure they have a track record of excellent customer service and claims processing.

- Policy Limits: Review the policy limits and deductibles to ensure you're not sacrificing quality coverage for cost savings.