Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Insurance Quotes That Won't Break the Bank

Discover affordable insurance quotes that won't empty your wallet! Find the best deals and save big today!

10 Tips for Finding Affordable Insurance Quotes

Finding affordable insurance quotes can be challenging, but with the right approach, you can save money while getting the coverage you need. Start by comparing quotes from multiple insurers, as prices can vary significantly based on their underwriting criteria. Utilize online comparison tools to streamline this process. Additionally, consider bundling your policies—many providers offer discounts for combining home, auto, and other types of insurance, which can lead to lower overall rates.

Another effective strategy is to evaluate your coverage needs and eliminate unnecessary add-ons. Review your existing policies and identify any overlapping coverages or terms that might not be applicable to you. Furthermore, increase your deductible if you can afford it; this can often lower your premium significantly. Lastly, don't hesitate to negotiate with insurance agents or brokers. They may have access to discounts or special offers that aren't widely advertised, helping you discover even more affordable insurance quotes.

Understanding Different Types of Insurance: Which One Fits Your Budget?

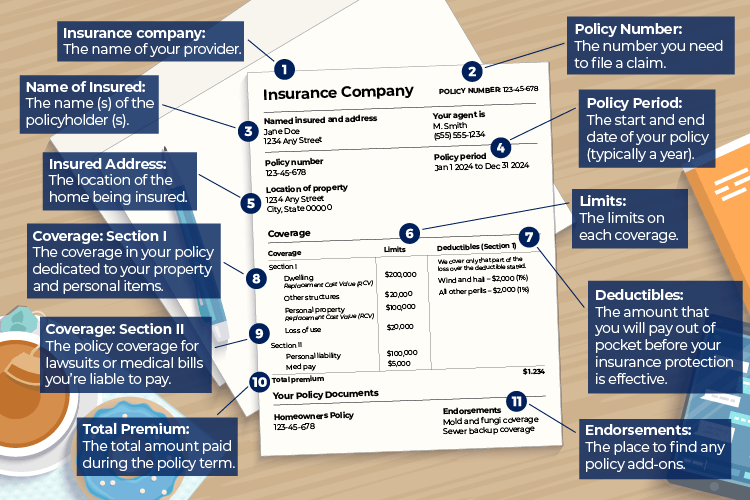

Understanding the various types of insurance is crucial for making informed decisions that align with your budget. Generally, insurance can be categorized into several key types: health insurance, auto insurance, homeowners insurance, and life insurance. Each type serves a unique purpose and offers different coverage levels. For instance, health insurance protects against medical expenses, while auto insurance covers damages and liabilities related to vehicle accidents. Knowing these differences can help you choose the right policy that fits your financial situation.

When it comes to selecting the right insurance, budget considerations play a vital role. Start by assessing your financial needs and obligations to determine how much coverage you can afford. It's helpful to create a list of essential factors to consider, such as:

- Your current financial situation

- The value of the assets you want to protect

- Potential risks you face in everyday life

- Differences in premiums and deductibles among different policies

By following these guidelines, you can narrow down your options and find the types of insurance that not only meet your needs but also fit within your budget.

How to Compare Insurance Quotes and Save Money

Comparing insurance quotes is a crucial step in finding the best coverage at the most affordable price. Start by gathering multiple quotes from different providers; this can be done easily online or through local agents. Make sure to compare similar coverage levels to ensure a fair evaluation. Additionally, consider the deductibles and limits of each policy, as these can significantly impact your out-of-pocket expenses. Don't hesitate to ask questions about any terms or conditions you don’t understand; a reliable agent will be happy to clarify.

Once you have your quotes, create a comparison table to outline key features and prices. This visual representation can help you quickly identify which policy offers the best value. In your table, include factors like premium costs, customer service ratings, and the claims process. Remember, the cheapest option isn't always the best; balance affordability with the quality of coverage. By staying organized and informed, you can confidently choose an insurance plan that meets your needs while saving money.