Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Insurance Showdown: Who Offers the Best Bang for Your Buck?

Discover the ultimate insurance showdown and find out who truly offers the best value for your dollar—don't miss out!

Top 5 Factors to Consider When Choosing Insurance: Finding the Best Value

When it comes to selecting insurance, understanding the fundamental factors can lead you to find the best value for your needs. Here are the top five considerations:

- Coverage Options: Evaluate the types of coverage offered. Ensure that the policy adequately protects your assets without unnecessary extras.

- Cost: Compare premiums from different providers. While it's essential to keep costs among the highest on your list, remember that lower prices may sometimes result in less comprehensive coverage.

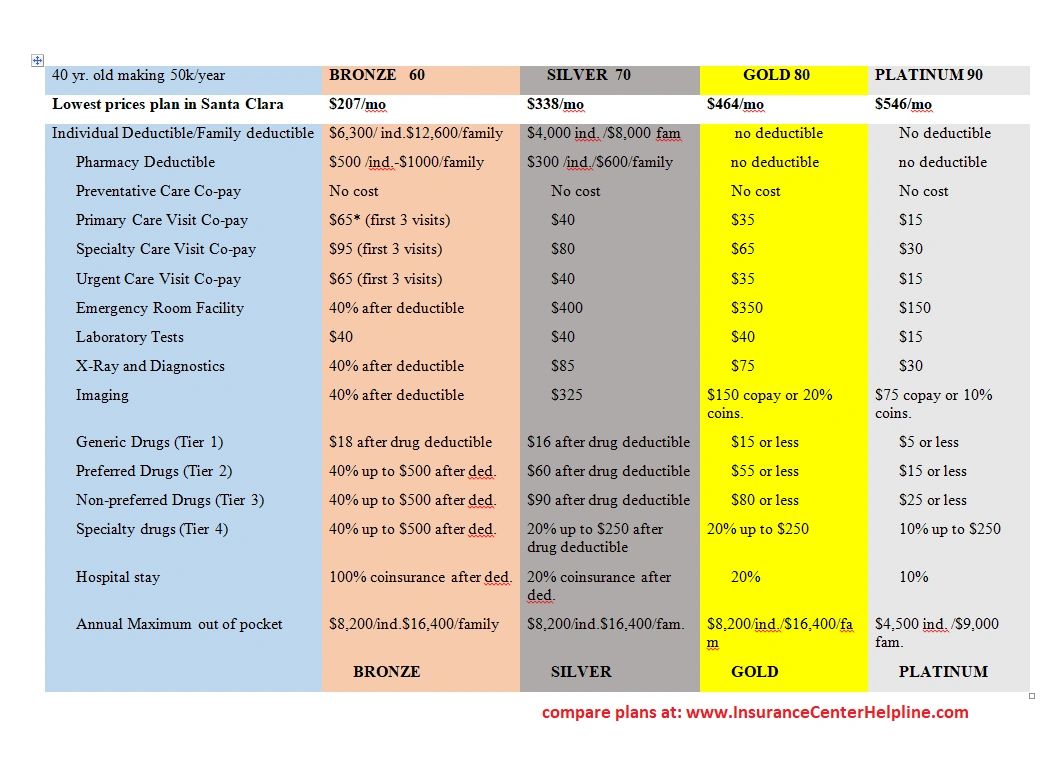

- Deductibles: Look at the deductible amounts associated with your policies. A higher deductible can lower your premium but may increase your out-of-pocket expenses in the event of a claim.

- Claims Process: Investigate how each company handles claims. A smooth and efficient claims process is crucial during stressful times when you need to depend on your insurance.

- Customer Reviews: Research customer feedback and reviews. Hearing about other customers' experiences can provide insight into the company's reliability and quality of service.

Ultimately, finding the best value in insurance involves a balance between adequate coverage and affordability. By assessing these factors—coverage options, cost, deductibles, claims process, and customer reviews—you can make a more informed decision. Taking the time to compare multiple policies will not only ensure you are well-protected but also help you avoid overspending. Remember, the goal is to find an insurance policy that meets your needs while providing peace of mind.

Insurance Comparisons: How to Evaluate Policies and Pricing

When it comes to insurance comparisons, evaluating policies and pricing is crucial to ensure you find the best coverage for your needs. Start by identifying your specific needs and the types of coverage required. For instance, if you're comparing car insurance policies, consider factors such as liability coverage, collision coverage, and comprehensive options. Once you have a clear understanding of what you need, create a comparison chart where you can list different insurance companies, their policies, and key features. This visual aid will help you quickly identify the pros and cons of each option.

Next, focus on pricing when making your insurance comparisons. Remember that the cheapest policy may not always provide the best value. Look into the deductible amounts, premium rates, and any hidden fees associated with each plan. Additionally, it's important to check for discounts that can lower your overall costs, such as multi-policy discounts or safe driver benefits. Always read the policy details thoroughly before making a decision, as understanding coverage limits and exclusions can prevent unwanted surprises down the line. By taking the time to evaluate policies and pricing carefully, you can secure the most suitable insurance coverage for your lifestyle.

Are You Getting the Most Out of Your Insurance? Tips for Cost-Effective Coverage

When it comes to managing your insurance, understanding the specifics of your coverage is crucial. Are you getting the most out of your insurance? Many people overlook the importance of reviewing their policies regularly. Insurance companies often provide a variety of options, and your needs may change over time. Therefore, it's important to assess your current coverage and make adjustments if necessary. Consider talking to your agent or using online tools to compare different plans, as this can lead to significant savings without compromising your protection.

To further enhance your cost-effective coverage, consider these practical tips:

- Bundle your policies: Many providers offer discounts for bundling home, auto, and other types of insurance.

- Increase your deductibles: A higher deductible can reduce your premium but ensure you have savings set aside for potential claims.

- Review discounts: Always ask about available discounts such as safe driver or loyalty discounts, which can lower your costs.