Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Paws Before You Pay: Why Pet Insurance is a No-Brainer

Discover why pet insurance is essential for your furry friend—protect your wallet and their health today!

The Top 5 Reasons Why Pet Insurance is Essential for Every Pet Owner

As a devoted pet owner, ensuring the health and well-being of your furry friend is a top priority. One of the most significant steps you can take is to invest in pet insurance. Here are the top 5 reasons why it is essential for every pet owner:

- Financial Protection: Veterinary bills can quickly add up, especially in emergencies. With pet insurance, you can alleviate the financial strain associated with unexpected illnesses or injuries.

- Comprehensive Coverage: Many policies cover a wide range of services, including accidents, illnesses, and routine care, ensuring that you can provide your pet with the best possible health care.

- Peace of Mind: Knowing that your pet is protected allows you to focus on their happiness and well-being, rather than worrying about the costs of treatment.

- Encourages Regular Check-Ups: With insurance, pet owners are more likely to take their pets for regular vet visits, leading to early detection of potential health problems.

- Customization: Pet insurance plans can be tailored to fit your needs and budget, offering flexibility in coverage options.

How Pet Insurance Can Save You Money in Unexpected Vet Bills

Unexpected vet bills can quickly add up, leaving pet owners feeling financially strained. This is where pet insurance becomes invaluable. By covering a variety of medical expenses, it helps alleviate the burden of costly treatments, surgeries, and emergencies that can arise at any time. With plans that often include routine care, preventative treatments, and unexpected illnesses or accidents, pet insurance ensures that you can focus on your pet's health rather than the financial implications of their care.

In addition to providing peace of mind, pet insurance also encourages pet owners to seek necessary medical attention without hesitation. When faced with large vet bills, many might delay treatment due to cost concerns, which can lead to more serious health issues down the line. By having insurance, you are more likely to take your pet in for regular check-ups and treatments, ultimately saving you money and ensuring a longer, healthier life for your furry friend. Consider investing in pet insurance today to safeguard your finances against unexpected vet costs.

Is Pet Insurance Worth It? A Deep Dive into the Benefits and Costs

When considering whether pet insurance is worth the investment, it's essential to evaluate both the benefits and costs. Many pet owners find that the peace of mind that comes with insurance can outweigh its price. For instance, if your pet requires an unexpected surgery or has a chronic illness, the expenses can quickly add up to thousands of dollars. With pet insurance, you can mitigate these costs, making it easier to afford necessary treatments. Additionally, some policies offer coverage for routine veterinary visits, which can also lead to substantial savings.

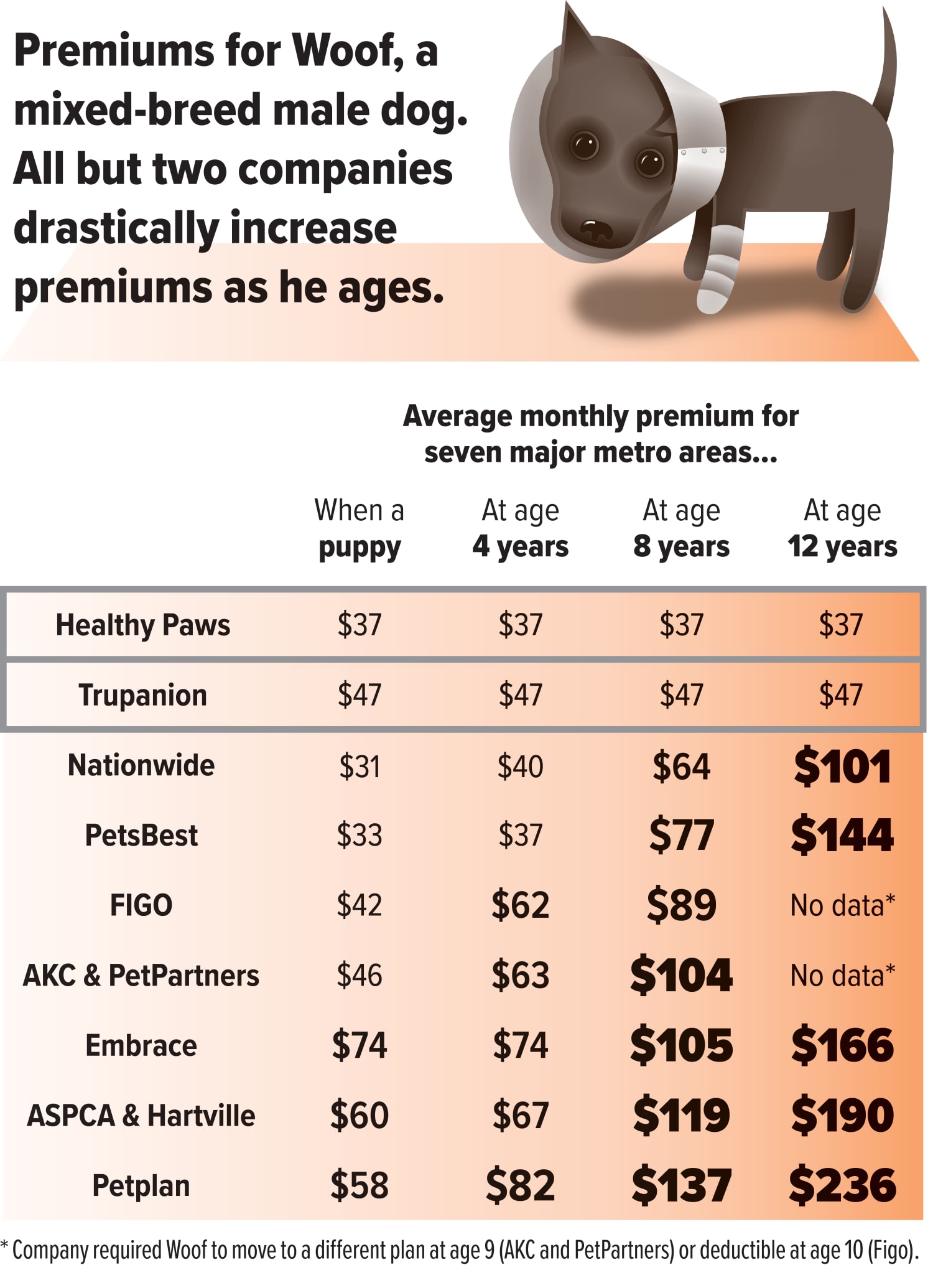

On the other hand, it's crucial to consider the costs associated with pet insurance. Monthly premiums can vary significantly based on factors like your pet's age, breed, and health status. Many plans also come with deductibles and co-pays, which means you'll still need to pay some out-of-pocket expenses before the insurance kicks in. Moreover, it's important to read the fine print and understand exclusions or waiting periods, as these may affect your plan's value. Ultimately, weighing the potential financial risk against the security that insurance provides is key to determining if pet insurance is worth it for you and your furry friend.