Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Quote It Like You Mean It: Navigating the World of Insurance

Unlock the secrets of insurance with expert insights and tips to make informed choices. Don't miss out on essential knowledge—click to learn more!

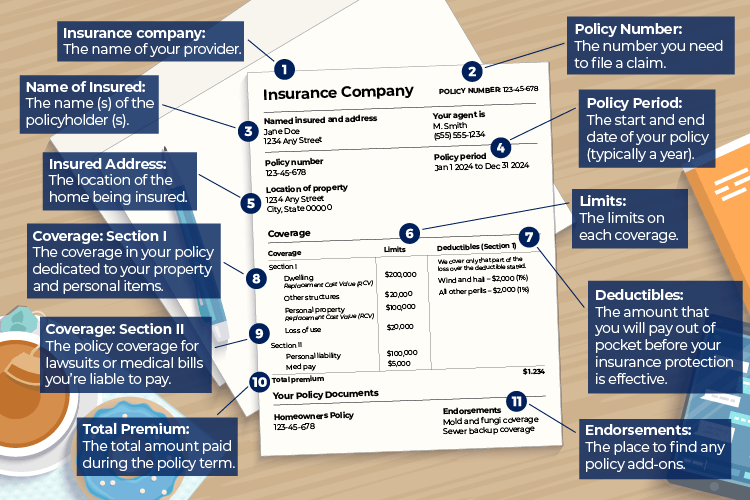

Understanding Your Insurance Policy: Key Terms Explained

When navigating the complex world of insurance, understanding your policy is crucial. It’s important to familiarize yourself with key terms that are often used in insurance documentation. Premium is the amount you pay, either monthly or annually, for your insurance coverage. Another essential term is deductible, which refers to the amount you must pay out of pocket before your insurance kicks in. Additionally, coverage limits define the maximum amount your insurer will pay for a covered loss, so knowing these limits can prevent unexpected expenses during a claim.

Moreover, the term exclusions highlights what is not covered by your policy, which is critical to understand to avoid any surprises when filing a claim. Policies may also contain riders, which are additional provisions that modify the coverage of the policy. For instance, a named-peril policy specifically covers only those risks that are outlined, whereas an all-risk policy covers everything except those specifically excluded. By being aware of these fundamental terms, you can make informed decisions about your insurance needs and ensure that you are adequately protected.

Top 5 Common Myths About Insurance Debunked

When it comes to understanding insurance, many people fall prey to common myths that can lead to misconceptions and poor decision-making. One of the most prevalent myths is that insurance is a waste of money. However, the reality is that insurance serves as a critical safety net, protecting individuals and families from potentially devastating financial losses. For instance, health insurance can cover unexpected medical expenses, while home insurance can safeguard against natural disasters and theft.

Another common myth is that all insurance policies are the same. This misconception often leads to individuals overspending or underinsuring themselves. In fact, there are numerous types of insurance, each tailored to specific needs, such as auto, life, or renters insurance. It's essential to research and compare different policies to find the right coverage for your situation. Understanding these differences can save you money and provide the necessary protection in times of need.

How to Choose the Right Insurance Coverage for Your Needs

Choosing the right insurance coverage can be a daunting task, but understanding your specific needs is the first step toward making an informed decision. Start by evaluating your personal situation, such as your lifestyle, financial status, and future goals. Consider creating a checklist that includes factors like:

- Your age and health status

- The value of your assets

- Your dependents and their needs

- Your budget for insurance premiums

Next, it's essential to compare different policies to find the best fit. Look for insurance coverage options that not only meet your needs but also align with your budget. Take the time to read the fine print and understand the terms and conditions of each policy. Don't hesitate to seek advice from insurance agents or use online tools to get quotes and reviews. Remember, investing time in selecting the right coverage can save you money and provide peace of mind in the future.