Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Quote Me If You Can: Cracking the Code of Insurance Quotes

Uncover the secrets of insurance quotes and save big! Discover tips to decode rates and find the best deals today.

Understanding the Factors That Influence Your Insurance Quote

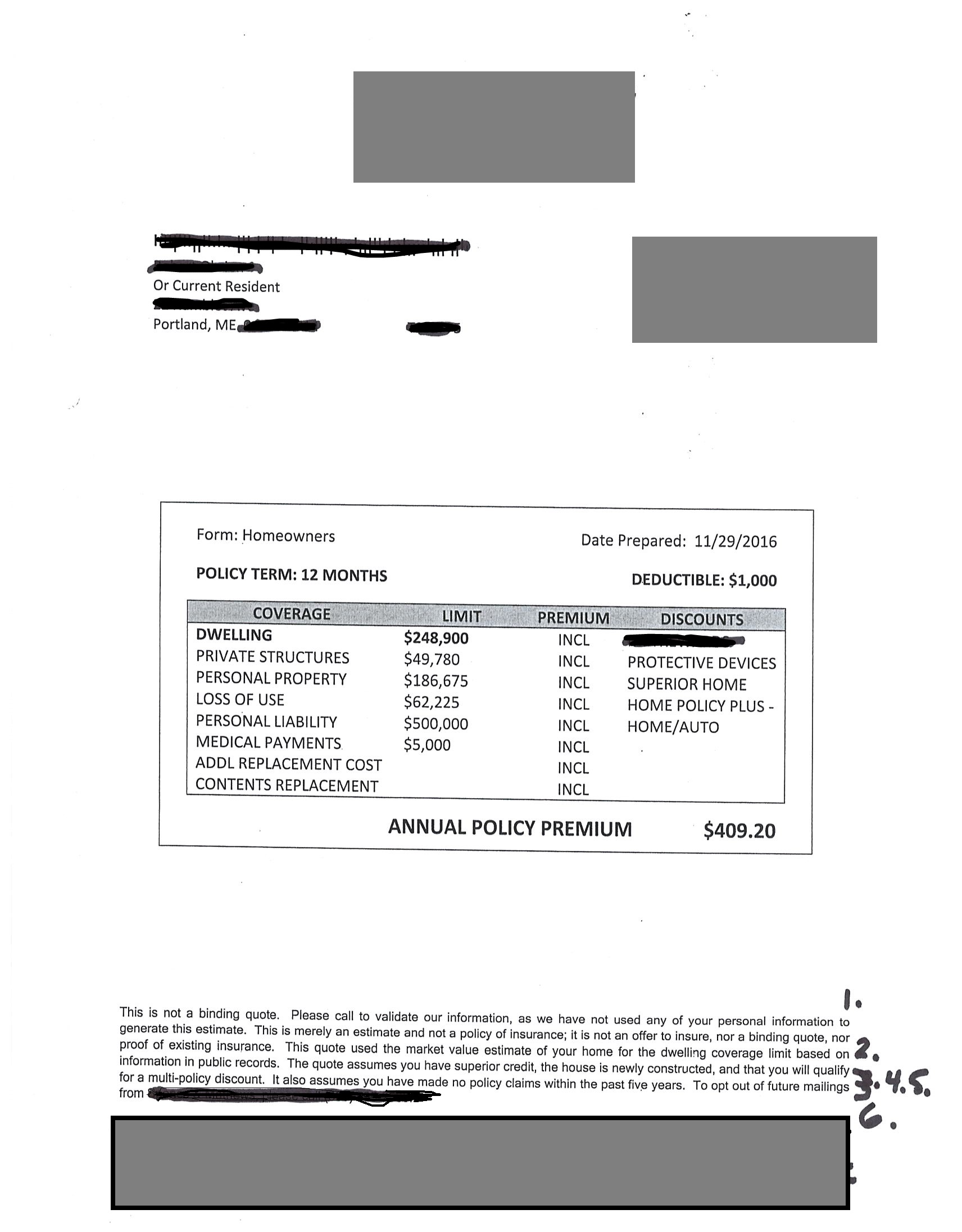

When it comes to understanding your insurance quote, several factors come into play that insurance companies consider. These factors can vary significantly depending on the type of insurance you are looking for, be it auto, health, or home insurance. Common elements that influence your quote include age, location, driving history (for auto insurance), and even credit score. Each of these factors helps insurers assess the level of risk they would be taking on by insuring you, which directly impacts the quote they provide.

Moreover, the type and amount of coverage you choose will also affect your insurance quote. For instance, if you opt for a higher deductible or limit the coverage options, your quote is likely to be lower. Additionally, factors like claims history and the insurance provider's policies can also play crucial roles. By understanding these factors, you can take proactive steps to manage your insurance costs and potentially secure a more favorable quote in the future.

Top 5 Mistakes to Avoid When Comparing Insurance Quotes

When it comes to comparing insurance quotes, one of the biggest mistakes people make is failing to understand the coverage options they need. Instead of simply looking at the price, take the time to analyze what each policy offers. This includes reviewing deductibles, coverage limits, and exclusions. By doing so, you can avoid the pitfall of choosing a cheaper option that ultimately offers inadequate protection. Remember, the least expensive policy may not always be the best choice for your unique situation.

Another common mistake is not comparing similar policies. Many individuals fall into the trap of comparing apples to oranges, which can lead to confusion and poor decision-making. Make sure you are comparing insurance quotes that are based on similar coverage levels and terms. Create a checklist of the key factors you want to consider, such as premiums, benefits, and customer service ratings. This will help you make an informed decision and ensure that you choose the right policy for your needs.

How to Decode Insurance Terms: Your Guide to Better Quotes

When navigating the complex world of insurance, understanding the terminology can significantly improve your ability to compare quotes effectively. Many consumers find themselves overwhelmed by terms like "premium," "deductible," and "coverage limits." To help decode these phrases, consider creating a glossary of common insurance terms. For example, a premium is the amount you pay for your insurance policy, usually on a monthly or annual basis, while a deductible is the sum you are required to pay out of pocket before your insurance coverage begins to take effect. Familiarizing yourself with these terms can empower you to make informed decisions.

Furthermore, asking your insurance agent to clarify any confusing terms is a vital step in ensuring you receive the best possible quotes. Insurers often have different jargon for similar concepts, which can lead to misunderstandings. For instance, some companies may refer to a "liability limit" as "coverage limit." By taking the time to ask questions and understand the details, you can uncover potential savings and select a policy that truly meets your needs. Remember, knowledge is key; the more you know about what you're buying, the better equipped you'll be to identify the right options at the best price.