Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Renters Insurance: Because Your Couch Deserves Better

Protect your belongings! Discover why renters insurance is a must-have for your couch and peace of mind. Don't wait—learn more now!

What Does Renters Insurance Cover? A Comprehensive Guide

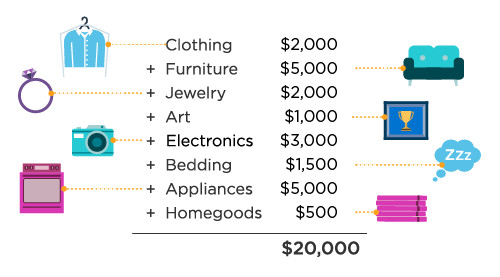

Renters insurance is designed to protect tenants from unexpected events that can lead to financial losses. Typically, it covers personal belongings, such as furniture, electronics, clothing, and other personal items, from risks like theft, fire, and water damage. For instance, if your apartment suffers from a burst pipe that damages your laptop, your renters insurance policy may cover the cost of repair or replacement. Additionally, renters insurance often includes liability coverage, which protects you if someone gets injured in your rented space and decides to sue.

Another critical aspect of renters insurance is additional living expenses (ALE) coverage. This component helps pay for temporary housing and related expenses if your rental unit becomes uninhabitable due to a covered event, such as a fire or natural disaster. Overall, understanding the specific coverages provided by your policy is essential. It's advisable to carefully review your renters insurance policy and consult with an insurance agent to ensure that you have adequate protection tailored to your individual needs.

Top 5 Reasons Why Your Couch Needs Renters Insurance

When it comes to protecting your belongings, renters insurance is a must-have, especially if you own a couch that serves as the centerpiece of your living room. First and foremost, in the event of a theft or fire, this type of insurance can cover the replacement costs of your furniture, including that stylish couch you just bought. Imagine the peace of mind you would have knowing that your investment is protected. According to experts, having this coverage is not only smart but also a necessity for anyone who rents.

Additionally, renters insurance provides liability coverage, which is crucial when you host friends or family in your home. If someone accidentally spills a drink on your couch or causes damage while visiting, your renters insurance can help cover the cost of repairs or replacements. This means that you can enjoy entertaining guests without the stress of worrying about potential mishaps. Ultimately, renters insurance is an affordable way to safeguard your couch and other belongings, making it an essential part of responsible renting.

Is Renters Insurance Worth It: Answering Your Burning Questions

When considering whether renters insurance is worth it, it's essential to evaluate what this type of insurance covers. Renters insurance typically protects personal belongings against theft, fire, and certain natural disasters, offering peace of mind for tenants. Without it, you risk losing everything you've worked hard to acquire if an unexpected incident occurs. Additionally, many landlords require tenants to have renters insurance as part of their lease agreement, making it a necessary expense for renters.

Moreover, renters insurance can provide liability coverage, protecting you from legal claims if someone is injured in your rental unit. For example, if a guest slips and falls in your apartment, your renters insurance can help cover the associated medical costs and legal fees, saving you from potentially crippling expenses. Considering these factors, investing in renters insurance often proves to be a wise decision, offering financial security and safeguarding your personal assets.