Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Renters Insurance: The Unsung Hero of Your Lease Agreement

Discover why renters insurance is the ultimate safeguard for your lease—protect your belongings and peace of mind today!

Understanding Renters Insurance: What Every Tenant Should Know

Understanding Renters Insurance is essential for every tenant, as it provides a safety net for your personal belongings and liability coverage. Unlike homeowners insurance, which covers the structure of the home, renters insurance focuses on protecting your possessions within the rented space. This insurance typically covers theft, fire, and certain natural disasters. As a tenant, you may think that your landlord’s insurance will protect you, but it's crucial to realize that their policy only covers the building itself and not your personal items. Therefore, securing renters insurance can offer peace of mind and financial support in unexpected situations.

When considering a renters insurance policy, it’s important to evaluate the coverage options available. Most policies offer two key components: personal property coverage and liability protection.

- Personal property coverage: This covers the cost to replace or repair your belongings in the event of damage or loss.

- Liability protection: This provides financial coverage if someone is injured in your rental space or if you accidentally damage someone else's property.

Is Renters Insurance Worth It? Debunking Common Myths

Many renters often question whether renters insurance is truly worth the investment, leading to a plethora of misconceptions. One of the most common myths is that renters insurance is too expensive. In reality, the average cost of renters insurance is quite affordable, usually ranging from $15 to $30 per month, depending on various factors such as location, coverage amount, and deductible. When considering the potential financial loss from theft, fire, or other disasters, this small monthly price can provide significant peace of mind and protection.

Another prevalent myth is that renters insurance is unnecessary if you live in a safe neighborhood. While it's true that some areas boast lower crime rates, the risk of unforeseen events like natural disasters, fire, or accidents remains. Renters insurance not only covers personal property loss but also provides liability coverage in case of accidents that cause injury to guests or damage to the property. Therefore, debunking these myths reveals that obtaining renters insurance is a sagacious decision for safeguarding your belongings and ensuring financial security, regardless of your living situation.

What Does Renters Insurance Cover? A Comprehensive Guide

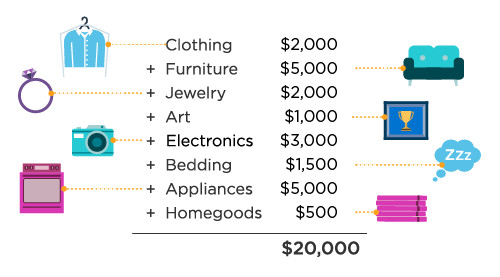

When considering what renters insurance covers, it's essential to understand the fundamental protections it provides. Typically, renters insurance safeguards your personal property against risks such as theft, fire, and certain types of water damage. For instance, if a fire damages your apartment and destroys your belongings, your renters insurance can help you recover the cost of replacing these items. The coverage usually extends to personal property within your apartment, including furniture, electronics, clothing, and even some personal belongings stored off-site.

In addition to personal property coverage, many policies offer liability protection, which is crucial if someone suffers an injury in your rented space. This can cover legal costs and medical expenses if you're found responsible for an accident. Moreover, renters insurance often includes additional living expenses if you need to find temporary housing due to a covered event, such as a major plumbing failure. In summary, understanding what renters insurance covers can help you make an informed choice that effectively protects your belongings and assets.