Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Sifting Through Insurance Quotes Like a Pro

Master the art of comparing insurance quotes effortlessly and save big! Discover insider tips to find the best coverage today!

5 Key Factors to Consider When Comparing Insurance Quotes

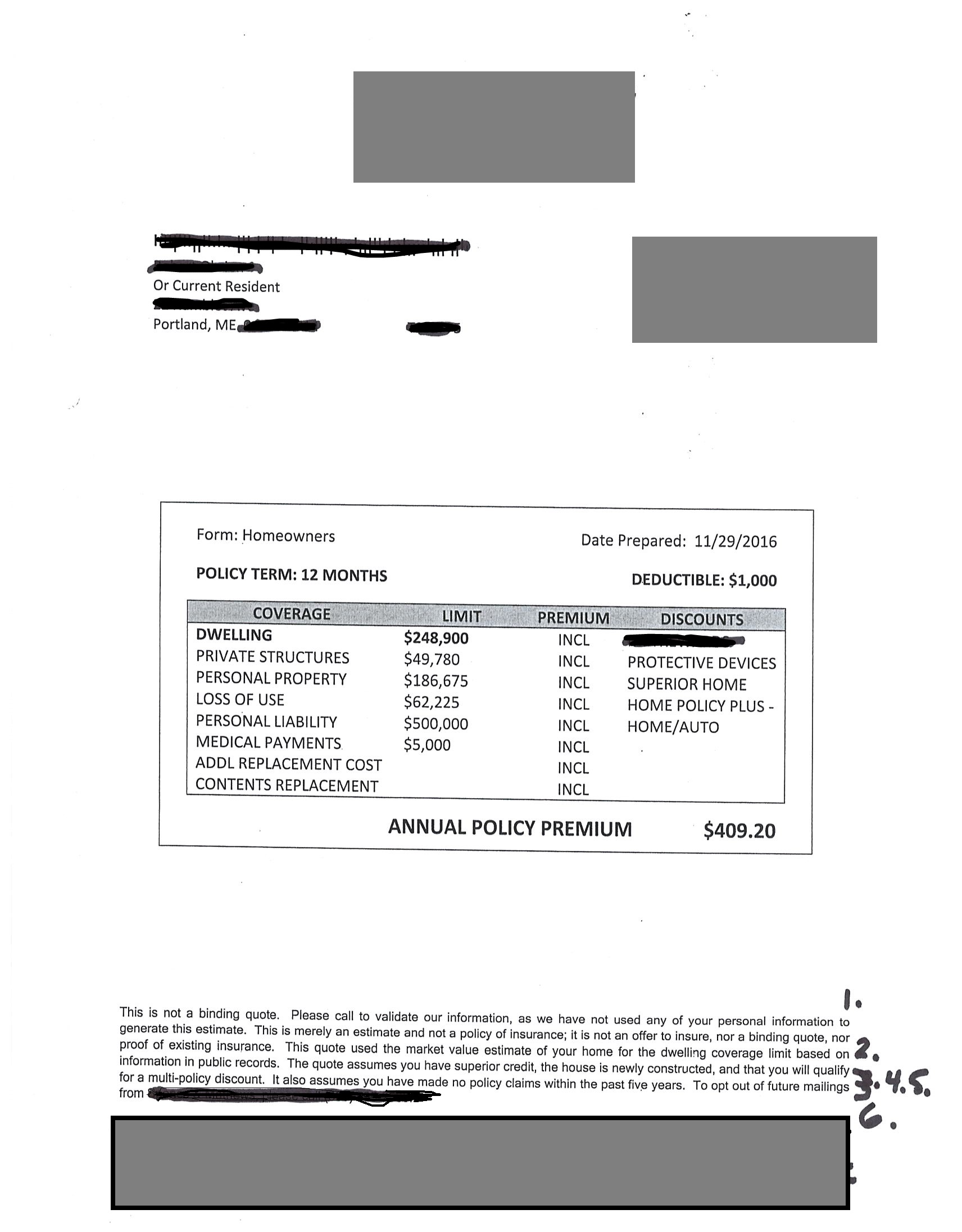

When comparing insurance quotes, it is essential to consider five key factors that can significantly impact your coverage and premiums. First, coverage options should be thoroughly evaluated. Different insurance providers offer varying levels of protection, so ensure you understand what each quote includes. Second, deductibles play a crucial role in determining your out-of-pocket expenses. A lower deductible often results in higher premiums, so weigh the trade-offs based on your financial situation.

In addition to coverage and deductibles, customer service is another critical factor to evaluate. Research the insurance companies' reputations and read customer reviews to gauge their responsiveness and support quality. Fourth, consider the discounts available on each policy. Many insurers offer multipolicy or safe driver discounts that can lower your premiums significantly. Finally, always assess the overall financial stability of the insurer by checking their ratings. A financially sound company is more likely to fulfill claims efficiently and effectively, ensuring peace of mind in your insurance choice.

How to Avoid Common Pitfalls in Insurance Quote Comparisons

When it comes to insurance quote comparisons, one of the most common pitfalls is overlooking the fine print in policy documents. Often, individuals focus solely on the premiums and overlook important details such as deductibles, coverage limits, and exclusions. To avoid this mistake, always read the policy terms thoroughly and ask questions if anything is unclear. Remember, the lowest premium may not provide the best value if it comes with high out-of-pocket expenses or inadequate coverage.

Another significant error is failing to consider multiple providers. Many consumers tend to get quotes from just a few companies, which limits their options and may not represent the best available deals. To ensure comprehensive insurance quote comparisons, you should broaden your search to include various insurers, both large and small. Additionally, utilizing online comparison tools can streamline this process, helping you make informed decisions based on more complete data.

The Ultimate Guide to Understanding Insurance Quotes: What You Need to Know

When you seek insurance quotes, it’s essential to understand the various factors that influence the cost and coverage options. Each quote you receive reflects your unique situation, which can include details like your age, location, credit history, and the type of coverage you require. To make the process easier, consider these key elements:

- Type of Insurance: Different types of insurance, such as auto, home, or life, have distinct criteria and pricing.

- Coverage Levels: The amount of coverage you choose impacts your premium; more coverage typically means higher costs.

- Deductibles: A higher deductible can lower your premium, but it also means more out-of-pocket expenses when you file a claim.

Understanding insurance quotes doesn’t stop at mere numbers; it's about making informed choices tailored to your needs. When comparing quotes, ensure you look beyond the price tag. Evaluate each policy's terms, limitations, and exclusions, as these can significantly affect your benefits in the event of a claim. For example, two quotes might appear similar in price, but one may offer broader coverage options or have a better claims process. Remember, the goal is to secure a policy that not only fits your budget but also provides peace of mind with adequate protection.