Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

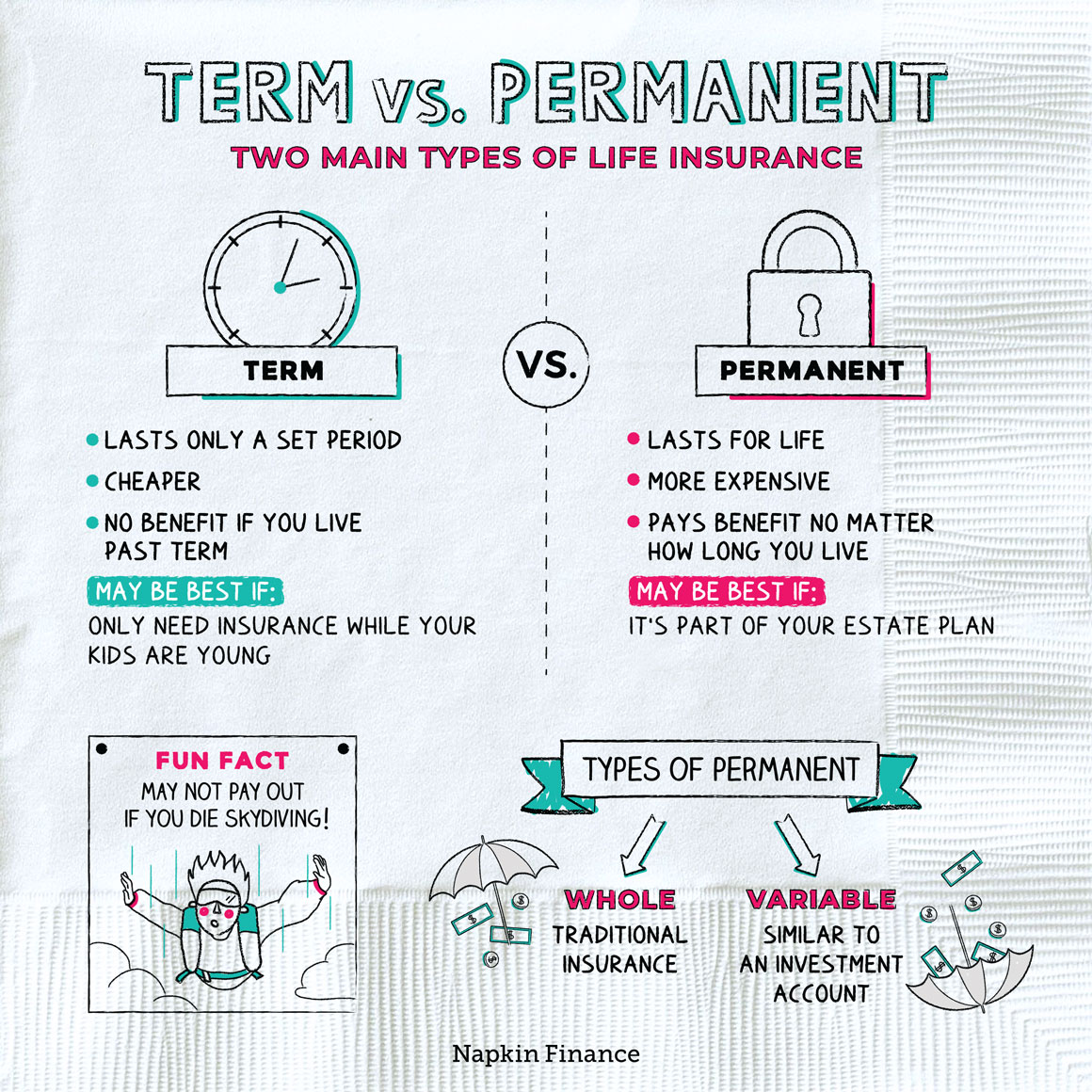

Term Life Insurance: It's Not Just for the Grim Reaper

Discover why term life insurance is a smart choice for everyone, not just a safety net for the afterlife. Secure your family's future today!

Why Term Life Insurance is a Smart Financial Move for Young Families

For young families, making sound financial decisions is crucial for long-term stability and peace of mind. Term life insurance is a smart financial move that provides a safety net, ensuring that your loved ones are protected in the event of an untimely death. With affordable premiums, this type of policy allows families to secure adequate coverage during critical years when financial obligations, such as mortgages and child-rearing costs, are at their peak. By investing in term life insurance early, families can lock in lower rates, making it a financially savvy decision.

Additionally, term life insurance offers flexibility and simplicity, which is particularly beneficial for young families. Most policies have straightforward terms and are easy to understand, allowing families to focus on their future while knowing they have a financial cushion. When the covered term ends, you can reassess your needs based on your family's situation at that time, whether that involves renewing the policy or transitioning to a different type of coverage. In summary, incorporating term life insurance into your financial planning is an essential step for young families wanting to safeguard their financial future.

Common Misconceptions About Term Life Insurance You Should Know

One of the most prevalent misconceptions about term life insurance is that it is only beneficial for younger individuals. Many people believe that once they reach a certain age, purchasing term life insurance becomes irrelevant or unattainable. However, this is far from the truth. Term life insurance can be an excellent choice for older adults, especially those who have dependents, a mortgage, or significant debts. It provides a safety net and peace of mind, ensuring that loved ones are financially supported, regardless of age.

Another common myth is that term life insurance does not pay out if the policyholder dies after the term ends. This misunderstanding stems from not fully grasping how term life insurance works. In reality, if the policyholder passes away during the contracted term, their beneficiaries will receive a payout. However, if the term expires and the policyholder is still living, the coverage simply ends, and no money is paid out. This leads many to overlook the value of renewal or conversion options, which can extend coverage even after the initial term.

How to Choose the Right Term Life Insurance Policy for Your Needs

Choosing the right term life insurance policy can seem overwhelming, but understanding your needs is crucial. Start by assessing your financial obligations, such as mortgage payments, education expenses, and dependents' needs. Consider the duration for which you want coverage, whether it's for a specific term that aligns with your children's education or until your mortgage is paid off. Additionally, think about the amount of coverage you require; a common recommendation is to have a policy that covers at least 10 to 12 times your annual income.

Once you've determined your needs, compare various term life insurance policies from different providers. Look for policies that offer flexible terms and the option to convert to permanent coverage in the future. Don't forget to read the fine print and understand the exclusions, premiums, and any riders available that can enhance your policy. Finally, consider seeking advice from a licensed insurance agent or financial advisor to ensure you make a well-informed decision tailored to your financial landscape.