Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Whole Life Insurance: The Unexpected Financial Superhero

Discover how whole life insurance can be your unexpected financial superhero, offering security and benefits you never knew you needed!

What Is Whole Life Insurance and How Does It Work?

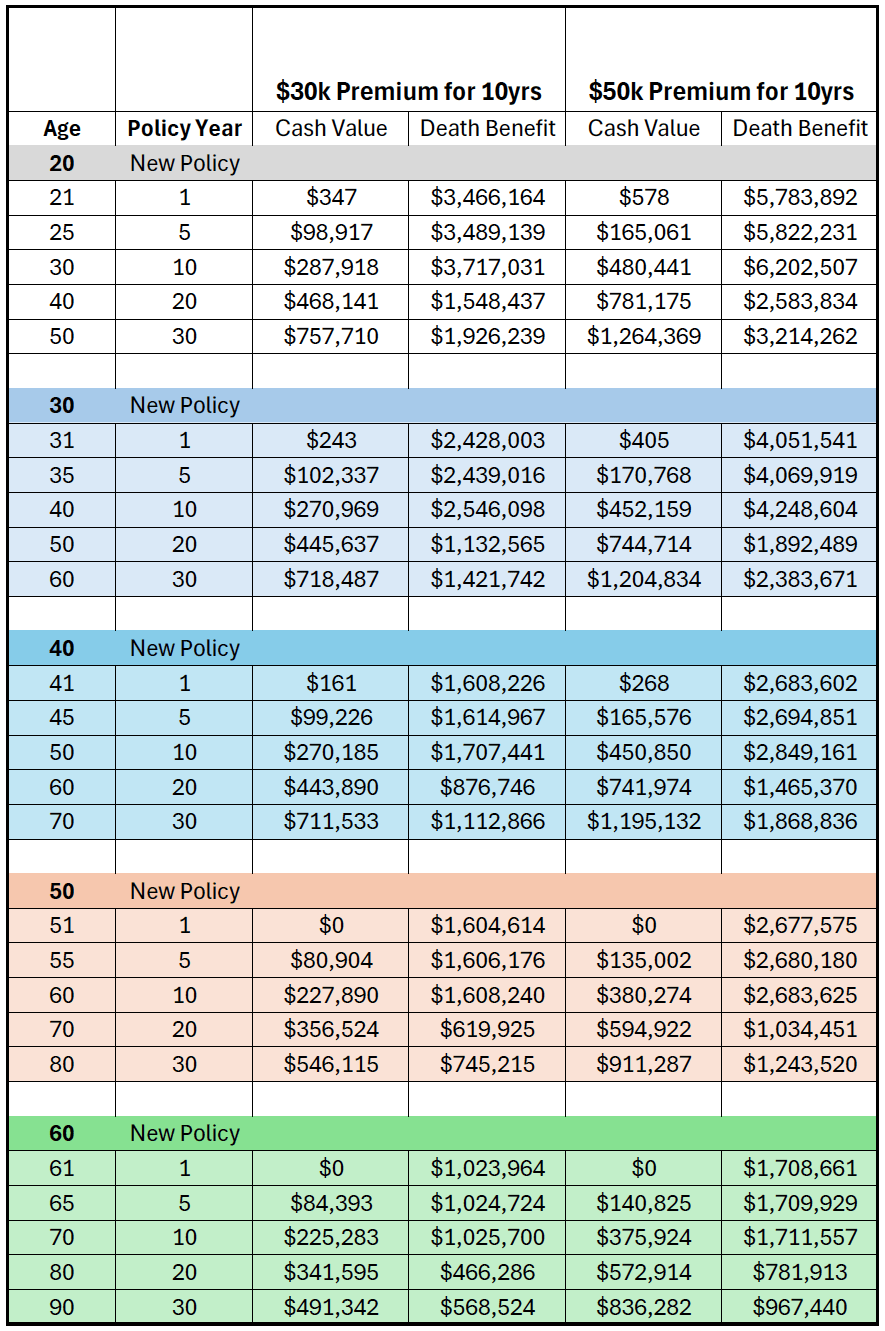

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as the premiums are paid. Unlike term life insurance, which offers protection for a specific period, whole life insurance combines a death benefit with a cash value component that grows over time. This cash value accumulates on a tax-deferred basis, allowing policyholders to borrow against it or even withdraw funds if needed. Whole life insurance is often viewed as a long-term financial planning tool, providing both security and savings.

In terms of functionality, whole life insurance works by requiring policyholders to pay a consistent premium throughout their lives. Initially, a portion of this premium goes toward the death benefit, while another portion is allocated to the cash value. As the policy matures, the cash value increases and can potentially lead to dividends that further enhance the financial benefits of the policy. It is essential to understand the terms and conditions associated with whole life insurance, including potential fees for early withdrawals and the impact of loans on the death benefit.

5 Surprising Benefits of Whole Life Insurance You Didn't Know About

Whole life insurance is often viewed simply as a means of providing financial security for your loved ones after your demise. However, there are several surprising benefits that make it a valuable asset beyond just a death benefit. Firstly, whole life insurance policies build cash value over time, allowing policyholders to access a portion of their policy's value through loans or withdrawals. This can be particularly helpful during emergencies or significant life events, such as buying a home or funding education. Moreover, the cash value grows at a guaranteed rate, providing a reliable source of savings that is not directly tied to market performance.

Another unexpected advantage is that the death benefit from a whole life insurance policy is typically tax-free for beneficiaries, which can preserve family wealth. Additionally, whole life insurance can serve as a powerful estate planning tool, helping to cover estate taxes and ensuring that loved ones receive the full value of an inheritance. Furthermore, many policies offer dividends that can be taken in cash, used to reduce premiums, or reinvested to purchase additional coverage, effectively improving the value of the policy over time. These features collectively illustrate how whole life insurance can serve as more than just a safety net; it can be a central component of a sound financial strategy.

Is Whole Life Insurance Right for You? Key Factors to Consider

When considering whole life insurance, it's essential to evaluate your financial goals and needs. This type of insurance offers lifelong coverage and a cash value component that grows over time. Before making a decision, ask yourself the following key questions:

- What is your current financial situation?

- Do you have dependents who would benefit from a death benefit?

- How does this fit into your long-term investment strategy?

Another crucial aspect to consider is the cost of whole life insurance. Premiums tend to be higher compared to term life insurance, so it's vital to assess whether your budget can accommodate this expense in the long run. Additionally, you should weigh the benefits against other investment options, such as stocks or retirement accounts, to determine if this policy aligns well with your overall financial plan. Ultimately, consulting with a financial advisor can help you make an informed decision tailored to your unique circumstances.