Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Why Renters Insurance is the Unseen Superhero of Your Apartment

Discover how renters insurance protects your apartment and belongings—your unseen superhero in times of crisis!

Top 5 Reasons Why Renters Insurance is a Smart Move for Apartment Dwellers

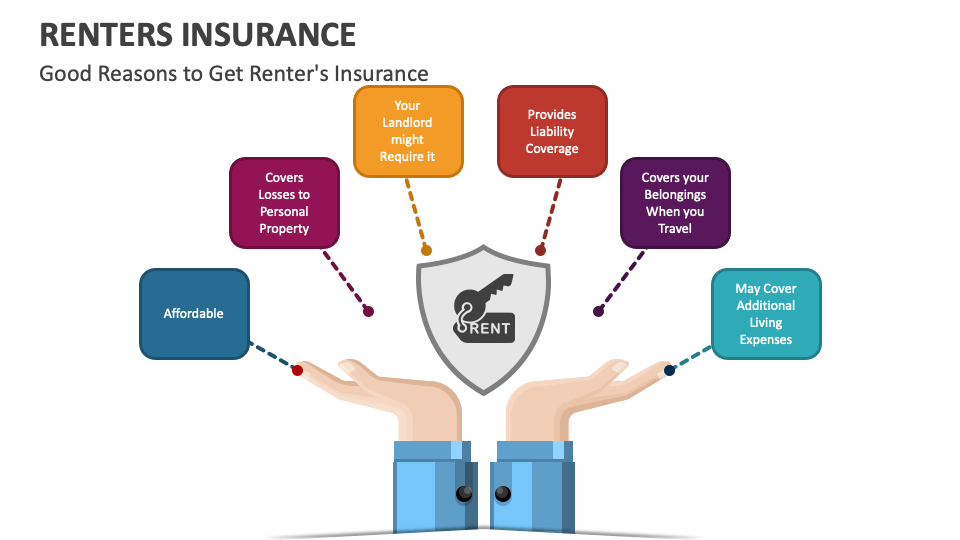

For those living in apartments, renters insurance is an essential safeguard that offers peace of mind. One of the top reasons to consider this protection is that it covers your personal belongings. In the event of theft, fire, or water damage, having renters insurance ensures that you can replace your items without bearing the entire financial burden. Instead of worrying about the potential devastation, you'll have a safety net to bounce back from unexpected losses.

Another compelling reason to invest in renters insurance is liability protection. If a guest injures themselves while visiting your apartment, you could potentially face hefty medical bills or legal fees. Renters insurance typically provides liability coverage, protecting you from these unexpected expenses. With this added layer of security, you can enjoy your living space with confidence, knowing that you're protected should an accident occur.

Is Renters Insurance Worth It? Debunking the Myths

When considering whether renter's insurance is worth it, many individuals are deterred by common myths that downplay its importance. One prevalent myth is that renters insurance is unnecessary because the landlord's insurance covers personal belongings. However, it's crucial to understand that a landlord's policy only covers the building and their liability, leaving tenants vulnerable in the event of theft, fire, or other disasters. By investing in renter's insurance, you can safeguard your personal possessions against unexpected occurrences and potentially save thousands in replacement costs.

Another misconception is that renter's insurance is prohibitively expensive. In reality, the average cost of renters insurance is often less than a few cups of coffee per month. Factors such as your location, the amount of coverage needed, and your credit score can influence the premium. However, when you weigh the cost against the peace of mind that comes with having financial protection for your belongings, it becomes clear that renter's insurance is a smart and economical choice for anyone renting a home.

How Renters Insurance Saves You from Financial Disaster in Your Apartment

Renters insurance is an essential safeguard for anyone living in an apartment, providing vital protection against unforeseen circumstances that could lead to significant financial loss. This type of insurance covers personal belongings in the event of theft, fire, or other disasters, ensuring that you won't be left with a heavy financial burden. For instance, if a fire damages your apartment and destroys your belongings, renters insurance can help you replace everything from your electronics to your furniture, alleviating the stress and financial impact of such an unfortunate event.

Moreover, renters insurance can also protect you from liability claims, which can save you from potentially devastating financial repercussions. If a guest is injured while visiting your apartment, you could be held responsible for their medical expenses. With renters insurance, you can avoid absorbing these costs on your own. The peace of mind that comes from having this insurance allows you to enjoy your living space without the constant worry of potential disasters looming over you, making it a wise investment for every renter.