Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

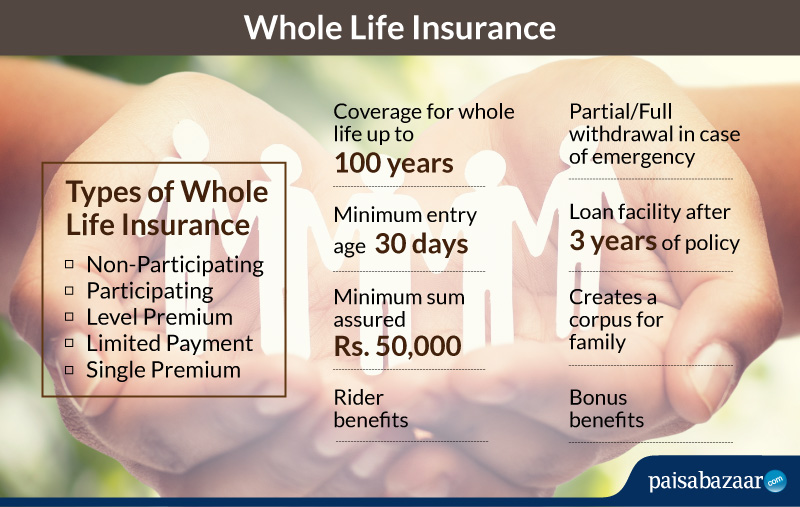

Why Whole Life Insurance is the Best Kept Secret in Wealth Building

Unlock the hidden power of whole life insurance and discover why it's the ultimate wealth-building secret you can't afford to ignore!

The Hidden Advantages of Whole Life Insurance in Wealth Accumulation

Whole life insurance is not just a safety net for your loved ones; it also serves as a potent tool for wealth accumulation. Unlike term life insurance, whole life policies build cash value over time, creating a growing asset that policyholders can borrow against or withdraw during their lifetime. This cash value grows at a predictable rate, allowing for stable long-term growth that can help in planning for significant future expenses, such as retirement or education costs. Additionally, the death benefit of a whole life policy is generally tax-free, making it a compelling option for those seeking to enhance their overall financial strategy.

Moreover, the advantages of whole life insurance extend beyond mere cash value accumulation. One significant benefit is the guaranteed coverage for the policyholder's entire life, which means that as long as premiums are paid, the policy remains in force. This feature provides peace of mind, knowing that beneficiaries will receive the death benefit regardless of when the policyholder passes away. Furthermore, the dividends generated from participating whole life policies can be utilized to increase the cash value, reduce premiums, or even purchase additional coverage, thus amplifying the overall benefits of the policy as a part of a comprehensive wealth accumulation strategy.

How Whole Life Insurance Can Serve as Your Secret Weapon for Financial Security

Whole life insurance is often overlooked in financial planning, yet it can be a powerful tool for those seeking long-term stability and security. Unlike term life insurance, which provides coverage for a limited period, whole life insurance offers coverage for your entire life, coupled with a cash value component that grows over time. This dual benefit not only ensures that your loved ones are protected financially in the event of your passing, but it also allows you to accumulate a cash reserve that can be accessed during your lifetime. As a result, it acts as a reliable safety net and can play a crucial role in your overall financial strategy.

Furthermore, the cash value of your whole life insurance policy can be borrowed against or withdrawn, making it a versatile asset in times of need. Whether you are looking to fund a child's education, manage unexpected expenses, or even invest in opportunities, your whole life policy can serve as a secret weapon in securing your financial future. The peace of mind that comes from knowing you have a stable financial resource at your disposal is invaluable, not only for you but also for your family, making whole life insurance a true cornerstone of financial security.

Is Whole Life Insurance the Ultimate Tool for Building Generational Wealth?

Whole life insurance has long been touted as a cornerstone in building generational wealth. It provides not only a death benefit but also a cash value component that grows over time. This growth is tax-deferred, making it an attractive option for those looking to enhance their financial legacy. Additionally, policyholders can borrow against their cash value, providing liquidity for investments or emergencies without the need to liquidate other assets. By utilizing whole life insurance, individuals can create a financial safety net for their heirs, ensuring that they are protected even in unpredictable circumstances.

Investing in whole life insurance also allows families to create a structured strategy for preserving wealth across generations. The predictable growth of the cash value and the guaranteed death benefit can be pivotal in estate planning. Families can leverage these policies to fund education for future generations, support business interests, or even cover estate taxes, thereby preventing the forced liquidation of assets. Ultimately, when used thoughtfully, whole life insurance can indeed be considered the ultimate tool for cultivating enduring wealth that lasts for generations.