Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Bargain Coverage: How to Score Cheap Insurance Without the Hassle

Unlock unbeatable insurance deals effortlessly! Discover insider tips to score the best coverage at budget-friendly prices today!

Top 5 Tips for Finding Affordable Insurance Without Compromise

Finding affordable insurance that meets your needs can be a daunting task, but it doesn’t have to be. Start by researching multiple providers to compare policies and premiums. Many insurance companies offer online calculators that can help you assess your coverage options and find the best rate. Additionally, consider bundling your insurance policies, such as home and auto, as many providers offer significant discounts for combining plans.

Another important tip is to review your coverage regularly. Life changes, such as getting married or moving to a new area, can affect your insurance needs. Make sure to adjust your policies accordingly to avoid paying for unnecessary expenses. Lastly, don’t hesitate to negotiate with your insurance agent – they may be able to offer you additional discounts or advice that can help you secure the affordable insurance you’re seeking without sacrificing quality.

The Ultimate Guide to Comparing Insurance Quotes Efficiently

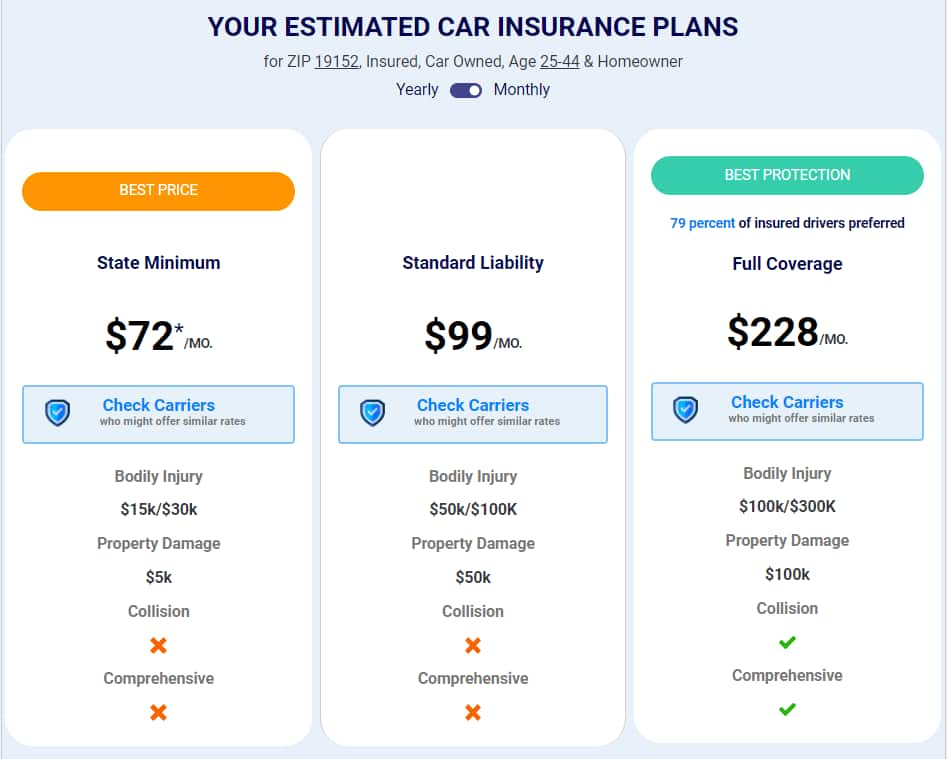

When it comes to finding the best insurance coverage at the right price, comparing insurance quotes efficiently is essential. With numerous providers and policy options available, it can become overwhelming to sift through each one. One effective method to streamline this process is to create a comparison spreadsheet. This allows you to list each insurer, their coverage options, premiums, deductibles, and any additional fees. To start, identify your coverage needs—this could include auto, health, home, or life insurance—and gather quotes from at least three to five different companies.

Once you've organized the insurance quotes in your spreadsheet, assess each option carefully. Look beyond the monthly premium; consider factors like customer service ratings, claim process efficiency, and the extent of coverage provided. You can utilize online tools like calculators to forecast potential out-of-pocket costs for claims against your projected premiums. After thorough analysis, not only will you make an informed decision, but you’ll also save time and potentially a lot of money as you navigate through insurance options.

Common Mistakes to Avoid When Seeking Cheap Insurance Options

When exploring cheap insurance options, one of the most common mistakes individuals make is prioritizing price over coverage. This often leads to policies that don't adequately meet their needs, resulting in higher out-of-pocket expenses during a claim. It’s crucial to analyze what is covered by the policy; for instance, if you are seeking auto insurance, ensure that essential aspects like liability and collision coverage are included. Failing to do so can leave you vulnerable in the event of an accident.

Another common misstep is neglecting to compare multiple providers. Many consumers settle for the first quote they receive, believing it to be the best offer available. However, cheap insurance options can vary significantly between companies. To avoid this pitfall, take the time to request quotes from several insurers, considering both price and the reputation of the company in question. Utilizing online comparison tools can simplify this process and help you find the coverage that fits your budget without sacrificing quality.