Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

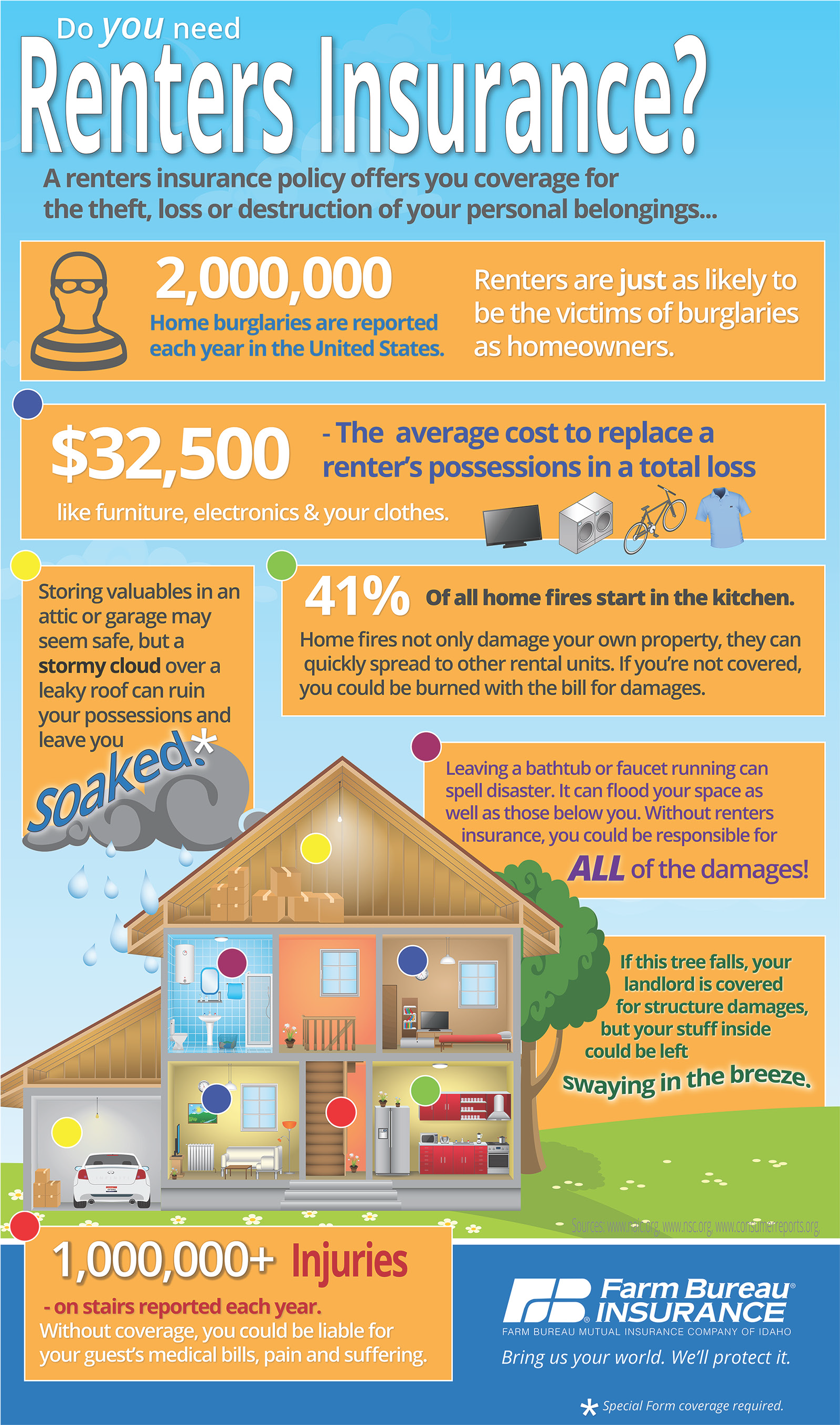

Coverage Confusion: Why Renters Insurance is Your Hidden Superhero

Uncover the surprising truth behind renters insurance—your hidden superhero that protects you from unexpected disasters!

Understanding the Basics: What Does Renters Insurance Actually Cover?

Renters insurance is designed to protect tenants from unexpected losses, providing financial coverage for personal belongings in the event of theft, fire, or other disasters. Typically, a standard renters insurance policy covers personal items such as furniture, electronics, clothing, and more. Additionally, it often includes liability coverage that protects you legally if someone gets injured in your rented space. It's essential to carefully review your policy to understand the specific coverage limits and exclusions that may apply.

Moreover, many renters insurance policies also offer additional living expenses coverage, which can help pay for temporary housing if your apartment becomes uninhabitable due to a covered loss. To ensure you have adequate protection, consider creating an inventory of your belongings and assessing their total value. This way, you can select a policy that aligns with your needs and offers sufficient coverage for your personal assets.

The Top 5 Myths About Renters Insurance Debunked

When it comes to renters insurance, many misconceptions can lead to hesitancy in obtaining this crucial coverage. One common myth is that renters insurance is unnecessary for those who rent apartments or homes. However, this belief couldn't be further from the truth. While your landlord's insurance might cover the building itself, it does not protect your personal belongings. Understanding that you could face significant financial loss due to theft, fire, or natural disasters is essential and highlights the importance of securing your own renters insurance.

Another prevalent myth revolves around the perception that renters insurance is prohibitively expensive. Many individuals are surprised to discover that the average cost of renters insurance is quite affordable, often less than a daily cup of coffee. This cost-effectiveness is a critical factor in debunking the myth, as it can provide peace of mind knowing that your possessions are protected without breaking the bank. Ultimately, investing in renters insurance is a small price to pay for comprehensive coverage against potential risks.

Do You Really Need Renters Insurance? 5 Questions to Consider

When it comes to protecting your personal belongings, renters insurance is a topic that often raises questions. While some may see it as an unnecessary expense, considering a few key factors can help determine whether it's worth it for you. Here are five essential questions to ask yourself:

- What is the total value of your personal belongings?

- What would it cost to replace everything in the event of theft or damage?

- How secure is your rental property?

- Do you have any high-value items that require additional coverage?

- What liabilities might you face if someone gets injured on your property?

Understanding the answers to these questions can give you a clearer picture of your need for renters insurance. For instance, if your belongings exceed a few thousand dollars, the cost of replacing them could be significantly higher than the premium you pay for coverage. Additionally, factors like living in an area prone to natural disasters or crime rates can influence your decision. By taking the time to evaluate your circumstances, you can make an informed choice about whether renters insurance is a wise investment for your peace of mind.