Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Insurance Smackdown: The Quest for the Best Coverage

Discover the ultimate showdown in coverage! Uncover tips, tricks, and the best insurance deals to protect what matters most.

Top 5 Insurance Myths Busted: What You Really Need to Know

When it comes to insurance, misinformation can lead to costly mistakes. One of the most persistent insurance myths is that all insurance policies are the same, leading consumers to choose coverage based solely on price. In reality, policies can vary significantly in terms of coverage limits, deductibles, and exclusions. It’s crucial to read the fine print and understand what you are buying. Additionally, relying on the advice of friends or family without researching your specific needs can leave you underinsured or overpaying for unnecessary coverage.

Another common misconception is that you don’t need insurance if you’re healthy or young. Many believe that major health issues or accidents are unlikely to happen at a younger age, but this perspective can be dangerously misleading. In fact, unexpected events can occur at any time, and having the right insurance can protect you from financial disaster. To help bust this myth, here are the top five insurance myths to be aware of:

- All insurance is the same.

- You only need insurance when you’re older.

- Insurance is too expensive.

- I don't need insurance if I have savings.

- Filing a claim will always increase my premiums.

How to Compare Insurance Policies: A Step-by-Step Guide

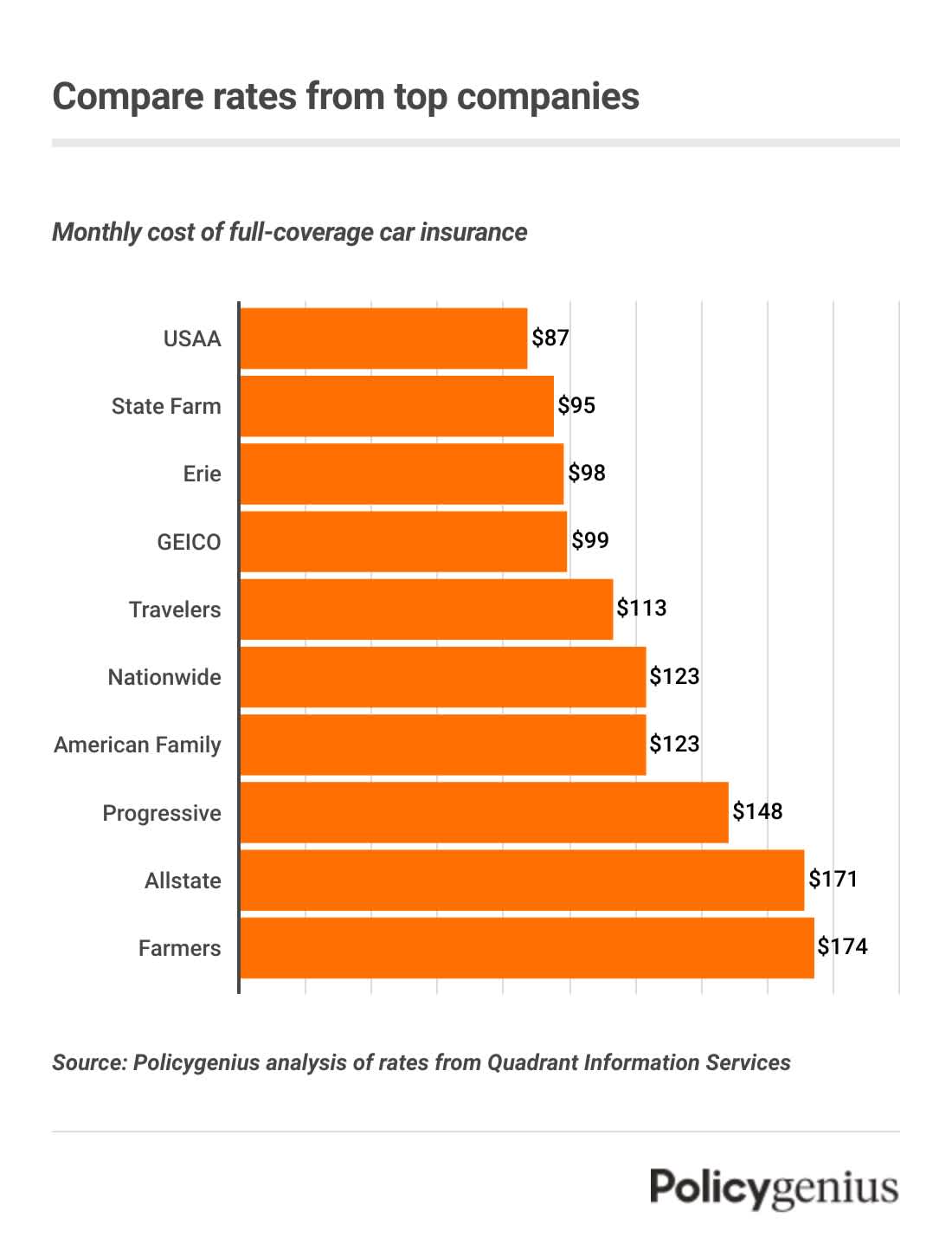

Comparing insurance policies can be a daunting task, but it is essential for finding the best coverage for your needs. Follow this step-by-step guide to streamline the process. Start by assessing your needs; consider factors such as the type of insurance (health, auto, home, etc.), coverage limits, and your budget. Next, gather quotes from multiple providers to ensure you're aware of the options available to you. Utilize online comparison tools, or reach out directly to insurance agents to obtain quotes for similar coverage, which allows for a straightforward evaluation.

Once you have your quotes, it's time to dive deeper into the details. Create a comparison chart that includes key elements such as premium amounts, deductibles, coverage limits, and any exclusions. This visual representation will help you identify the offerings that best meet your requirements. Don't forget to read customer reviews and check the insurer's financial stability, as a policy is only as good as the company backing it. Finally, trust your instincts and select the policy that gives you the peace of mind you deserve.

Are You Overpaying for Coverage? Key Questions to Ask Your Insurer

When it comes to insurance, many individuals unknowingly overpay for coverage that doesn't adequately meet their needs. To ensure you're getting the best value for your money, it's crucial to ask your insurer the right questions. Start by requesting a detailed breakdown of your policy's coverage limits and deductibles. This will help you identify any unnecessary features you may be paying for. Additionally, consider asking about potential discounts you might qualify for, such as bundling multiple policies or maintaining a claim-free record.

Another important aspect to explore is your insurer's claims process. Are you comfortable with how they handle claims? Inquire about the average response time and how they communicate with policyholders during a claim. Understanding these details can significantly impact your experience and may reveal areas where you can save money. Lastly, always compare your current policy with offers from other insurers to see if there are better deals available. By asking these key questions, you can ensure that you aren't overpaying for coverage and are receiving the protection you truly need.