Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Quote This: How to Score the Best Insurance Deals

Unlock the secrets to scoring unbeatable insurance deals and save big! Discover expert tips and tricks to maximize your savings today!

Top 5 Tips for Finding the Best Insurance Quotes

Finding the best insurance quotes can be a daunting task, but with a systematic approach, you can simplify the process. First, it's essential to assess your specific insurance needs. Whether you are looking for auto, home, or health insurance, understanding what coverage is necessary will help you compare apples to apples. Second, gather multiple quotes from different providers. Websites like quote comparison tools can be invaluable here, providing a range of options tailored to your needs.

Next, consider factors beyond just the price. Some insurance companies may offer lower premiums but provide inadequate coverage or poor customer service. Fourth, read customer reviews and check the financial stability of the insurance providers to ensure you’re choosing a reputable company. Finally, don’t hesitate to ask for discounts. Many insurers offer discounts for bundling policies or maintaining a good driving record, which can significantly reduce your overall premiums.

Common Mistakes to Avoid When Shopping for Insurance

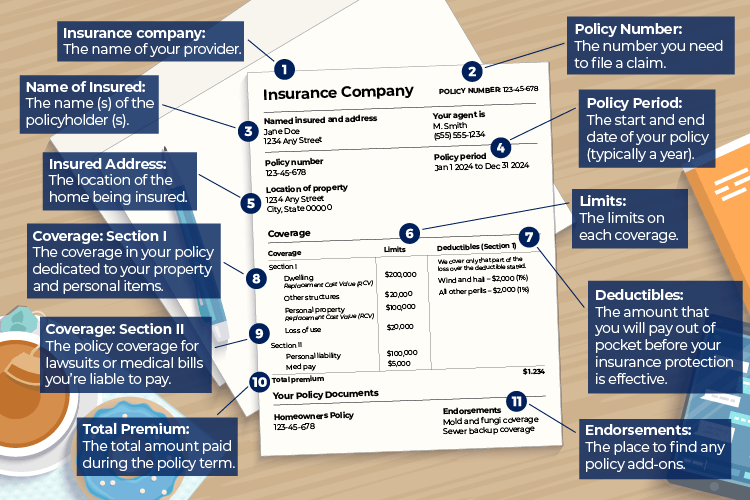

When shopping for insurance, one of the common mistakes many people make is failing to understand their coverage needs. It’s essential to assess your requirements before obtaining quotes. For example, homeowners insurance should reflect the value of your property and personal belongings. Neglecting to consider these factors can lead to inadequate coverage, leaving you vulnerable in times of need. Additionally, individuals often overlook the importance of reviewing their policies regularly. Your circumstances can change, and what might have been adequate coverage a few years ago may no longer suffice.

Another prevalent error is not comparing multiple insurance providers. Relying on a single company can limit your options and potentially lead to higher premiums. Instead, take the time to shop around and request quotes from different insurers. Create a checklist of what each policy covers, including deductibles, limits, and exclusions. This not only helps you understand your options better but also ensures you get the best value for your money. Lastly, don't hesitate to ask questions. Understanding the terms and conditions of your policy is crucial in avoiding future headaches.

How to Compare Insurance Quotes and Save Money

When it comes to comparing insurance quotes, the first step is to gather multiple quotes from different providers. This can be done easily online through comparison websites or directly from insurers' websites. Make sure to input the same information for each quote, such as your age, location, and coverage needs, to ensure accurate comparisons. Once you have your quotes, create a list that highlights the coverage options, deductibles, and premium amounts. Paying attention to these details can help you spot any significant differences that could lead to savings.

Next, consider not just the price but also the value of each policy. Look for hidden fees and the overall range of benefits included with each quote. For instance, some policies might offer extras like roadside assistance, rental car coverage, or lifetime renewability. Use a comparison table to organize your findings:

- List each insurer's name

- Note the premium amount

- Detail unique features of each plan