Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Shielding Your Castle: The Surprising Truth About Home Insurance

Discover the secrets of home insurance and how it protects your castle. Uncover surprising truths that could save you money and heartache!

5 Common Myths About Home Insurance Debunked

When it comes to home insurance, there are numerous misconceptions that can leave homeowners confused and unprotected. One of the most common myths is that all home insurance policies cover natural disasters. However, many policies exclude specific events such as floods or earthquakes, making it crucial to read the fine print and understand what is and isn't covered. Homeowners should consider additional coverage options if they live in areas prone to such risks.

Another prevalent myth is that home insurance only covers the structure of the home. In reality, a good policy also protects personal belongings, liability claims, and additional living expenses in case your home becomes uninhabitable. To ensure comprehensive coverage, it is beneficial to regularly review and update your policy to reflect your current assets and lifestyle changes. By debunking these myths, homeowners can make informed decisions and secure their financial future.

What Does Your Home Insurance Actually Cover? A Deep Dive

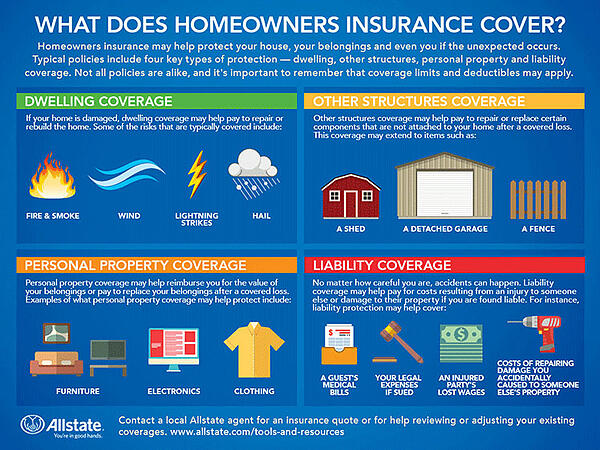

Understanding what your home insurance actually covers is vital for homeowners looking to protect their investments. Generally, standard home insurance policies provide coverage for your dwelling, personal belongings, liability, and additional living expenses. Dwelling coverage protects the physical structure of your home from perils such as fire, storm damage, and vandalism. In addition to the structure itself, personal property coverage safeguards your possessions inside the home, including furniture, electronics, and clothing, up to a specified limit.

Moreover, liability coverage is a crucial aspect of home insurance, protecting you in the event of injury to guests or damage to their property occurring on your premises. This coverage not only protects your assets but also helps cover legal fees if you face a lawsuit. Lastly, in scenarios where your home becomes uninhabitable due to a covered risk, additional living expenses (ALE) coverage kicks in to pay for temporary housing and other necessary expenses, ensuring that you and your family have a safety net during difficult times.

Is Your Home Underinsured? Signs You Need to Reevaluate Your Coverage

Homeownership is a significant investment, and ensuring that your property is adequately protected is crucial. Many homeowners might not realize they are underinsured, which can lead to substantial financial losses in the event of disaster. Here are some signs you may need to reevaluate your coverage: 1. You have made significant renovations or upgrades to your home. If you've added a new room or renovated your kitchen, your current policy may not cover the increased value of your home. 2. The value of your home has appreciated in the current market. It’s essential to keep up with real estate trends in your area to adjust your coverage accordingly.

Another indicator that you might be underinsured is if you haven't reviewed your policy in several years. Homeowners often overlook the fact that as prices change, their insurance limits may no longer be sufficient. Consider the following: 1. Are your personal belongings adequately covered? Items like electronics, jewelry, and collectibles often require additional coverage. 2. Have you evaluated your liability limits? Accidents happen, and if someone is injured on your property, having higher liability coverage can protect your financial future. Regular evaluations of your insurance policy can ensure you have the right coverage in place to safeguard your investment.