Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Whole Life Insurance: The Gift That Keeps on Giving

Discover why whole life insurance is the ultimate gift for your loved ones—financial security that never stops giving!

Understanding Whole Life Insurance: A Comprehensive Guide

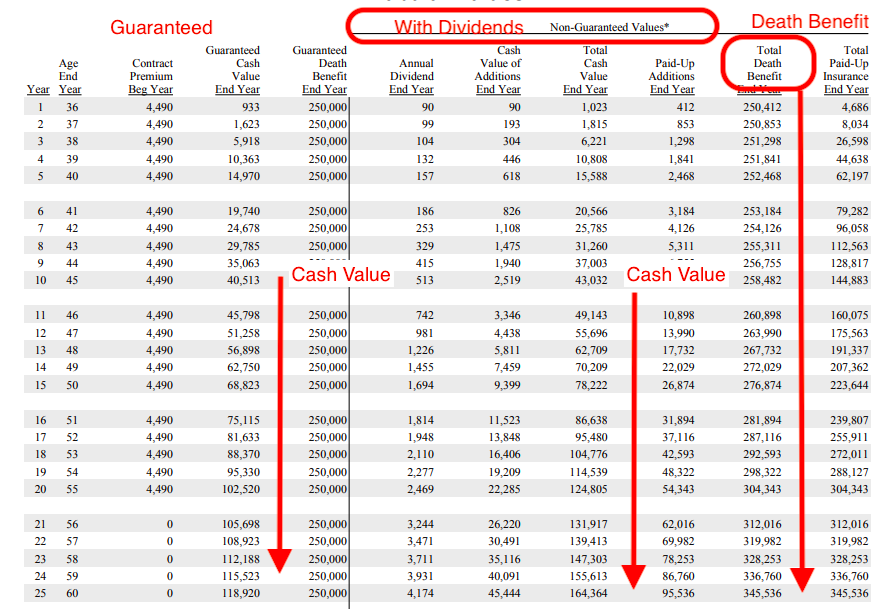

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. It combines a death benefit with a savings component, known as cash value, which grows over time on a tax-deferred basis. This dual function makes whole life insurance an attractive option for those looking to ensure financial security for their loved ones while also building wealth. Premiums are typically higher than term life insurance, but they remain constant throughout the policyholder's life, offering stability and predictability in financial planning.

Understanding the mechanics of whole life insurance is crucial for making informed decisions. Here are some key features to consider:

- Guaranteed Death Benefit: The amount paid out upon death is guaranteed, providing peace of mind.

- Cash Value Accumulation: A portion of the premium goes towards building cash value, which can be borrowed against or withdrawn.

- Dividend Payments: Some whole life policies may pay dividends, which can enhance the cash value or be used to offset premiums.

Top 5 Benefits of Whole Life Insurance You Didn't Know About

When considering financial security, many people are aware of the basic functions of whole life insurance, but there are several lesser-known benefits that can significantly enhance your financial planning. One of the most notable advantages is the cash value accumulation. Unlike term insurance, which only provides a death benefit, whole life policies build cash value over time, allowing you to borrow against it or cash it out if needed. This dual purpose makes whole life insurance not just a safety net, but also a strategic investment for your future.

Another compelling advantage is the tax advantages associated with whole life insurance. The cash value grows on a tax-deferred basis, meaning you won’t owe taxes on the growth as long as it remains in the policy. Furthermore, the death benefit is paid out tax-free, providing greater peace of mind for your beneficiaries. Overall, investing in whole life insurance offers unique benefits that serve both your current financial needs and your long-term goals.

Is Whole Life Insurance Worth It? Key Considerations for You

When evaluating whether whole life insurance is worth it, it's important to consider several key factors. Unlike term life insurance, which provides a death benefit for a specified period, whole life insurance offers lifelong coverage and includes a cash value component that grows over time. This can serve as a savings vehicle, allowing policyholders to borrow against the cash value or withdraw funds. However, the premiums for whole life policies are significantly higher than those for term life, which may not be feasible for everyone.

In addition to the financial implications, think about your long-term goals and family needs. If you prioritize leaving a legacy or ensuring that your loved ones are financially secure with guaranteed benefits, whole life insurance might be worth the investment. Conversely, if your primary goal is to cover temporary financial obligations, such as a mortgage or children's education, term life insurance might be a more cost-effective choice. Ultimately, assessing your individual circumstances and speaking with a financial advisor can help you make an informed decision.