Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Whole Life Insurance: Your Policy's Secret Superpowers

Unlock the hidden benefits of whole life insurance! Discover the secret superpowers of your policy and transform your financial future today!

Unlocking the Hidden Benefits of Whole Life Insurance: What You Need to Know

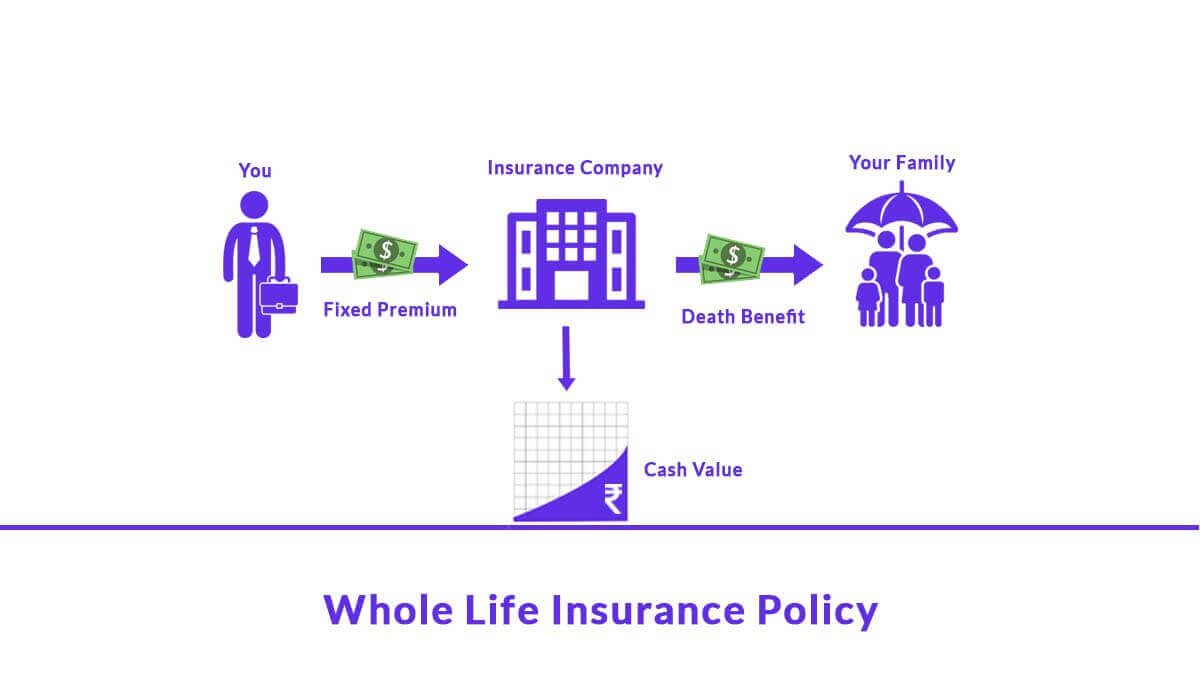

Whole life insurance is often misunderstood, yet it offers a wealth of hidden benefits beyond just providing a death benefit. One of the primary advantages is its cash value accumulation, which grows over time and can be borrowed against or withdrawn under certain conditions. This can be a valuable financial resource during retirement or in times of need, making it a versatile tool in your financial planning arsenal. Moreover, the premiums you pay remain consistent throughout your life, providing predictability in your budgeting.

Another significant benefit of whole life insurance is its death benefit guarantee, which ensures that your loved ones will receive a predetermined sum upon your passing, irrespective of market conditions. Additionally, whole life policies often come with dividends that can enhance your policy’s cash value or be used to lower premiums. These features not only make whole life insurance an essential component of a comprehensive financial strategy but also provide peace of mind, knowing that your family’s future is secured.

How Whole Life Insurance Can Be Your Financial Safety Net

Whole life insurance serves as a robust financial safety net for individuals and families, providing both protection and financial growth. Unlike term life insurance, which only offers coverage for a specified period, whole life insurance remains in force for the policyholder's entire life, ensuring that loved ones are financially supported no matter when they pass away. This policy not only guarantees a death benefit but also builds cash value over time, which can be accessed during your lifetime for emergencies, education, or retirement funding.

Moreover, the cash value of whole life insurance grows at a predictable rate, providing a sense of stability in an unpredictable financial landscape. As a form of permanent insurance, it empowers policyholders to plan for long-term financial wellbeing. By using whole life insurance as a central element of your financial strategy, you can enhance your overall portfolio, safeguard against unforeseen circumstances, and ultimately create a lasting legacy for your family.

Is Whole Life Insurance Right for You? Understanding Its Advantages and Disadvantages

When considering whether whole life insurance is right for you, it's crucial to weigh its advantages. One of the most significant benefits is the guaranteed death benefit, which ensures that your beneficiaries receive a predetermined amount upon your passing. Additionally, whole life policies accumulate cash value over time, allowing you to borrow against this amount or surrender the policy for cash. This dual purpose of providing insurance coverage and acting as a savings component offers long-term financial security. Furthermore, premiums remain level throughout the life of the policy, which can simplify budgeting and provide peace of mind.

However, whole life insurance is not without its disadvantages. The premiums tend to be significantly higher than those of term life insurance, which can be a financial strain for some individuals. Additionally, the cash value growth is relatively slow compared to other investment opportunities, which may deter those looking for more aggressive ways to build wealth. Moreover, if you do not keep up with your premiums, the policy can lapse, potentially leaving you without coverage when you need it most. Therefore, it is essential to carefully evaluate your financial goals and needs before deciding if whole life insurance is the right policy for you.