Unveiling TikTok Advertising Secrets

Explore the latest trends and insights in TikTok advertising.

Why Renters Insurance is the Secret Sauce for Stress-Free Living

Discover how renters insurance can be your ultimate peace-of-mind solution, turning stress into seamless living!

The Top 5 Reasons Renters Insurance is Essential for Peace of Mind

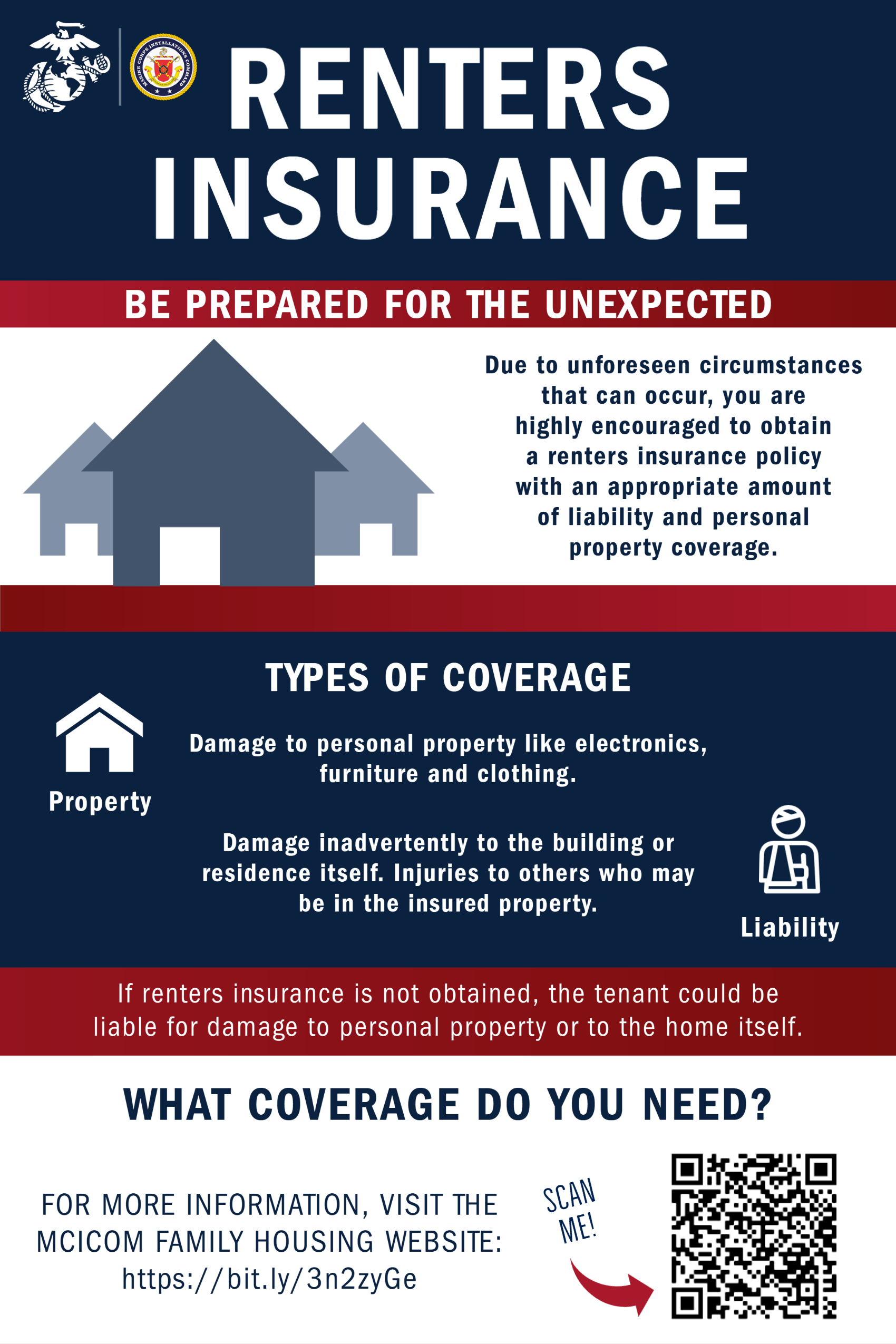

Renters insurance is often overlooked by tenants, yet it serves as a crucial safety net for anyone renting a home. One of the top reasons to consider renters insurance is the protection it provides for your personal belongings. In the event of theft, fire, or water damage, having this insurance can help you recover your loss and replace essential items. Without it, you could be left financially vulnerable, facing the daunting task of replacing everything out-of-pocket.

Moreover, renters insurance also offers liability coverage, which is another compelling reason to invest in this type of policy. If someone is injured in your rented space, you could be held responsible for their medical expenses or damage they incur. Having renters insurance can protect you from these unexpected financial burdens, providing peace of mind that you're covered in various situations. In summary, investing in renters insurance safeguards your belongings and protects you from potential liabilities, making it an essential aspect of responsible renting.

How Renters Insurance Protects You from Unexpected Costs and Hassles

Renters insurance serves as a vital safety net for individuals renting their homes, providing protection against unexpected costs that can arise from various unforeseen incidents. As a renter, you may not be fully aware of the potential financial burdens posed by events such as theft, fire, or natural disasters. With a reliable renters insurance policy in place, you can rest assured that your personal belongings, including electronics, furniture, and clothing, are covered against losses. This coverage can not only help you recover your valuables but also grant you peace of mind knowing that you're safeguarded from incurring hefty out-of-pocket expenses.

Moreover, renters insurance helps alleviate the hassles that can come with unexpected damage or loss. For example, if a pipe bursts in your apartment and damages your belongings, your insurance can cover both the cost of replacing those items and any necessary repairs. Additionally, many policies offer liability coverage, which means that if someone is injured while visiting your rented space, your insurance can help cover medical expenses and legal fees. By investing in renters insurance, you’re not just protecting your property; you’re also ensuring that you have a buffer against the countless inconveniences that life can throw your way.

Is Renters Insurance Worth It? Debunking Common Myths and Misconceptions

When considering whether renters insurance is worth it, many people fall victim to common myths that can cloud their judgment. One prevalent misconception is that renters insurance is unnecessary because personal belongings are often covered by the landlord's insurance policy. However, it's important to understand that a landlord's insurance typically only covers the building itself, leaving tenants vulnerable to loss or damage to their personal property. In fact, renters insurance offers a safety net that can protect against theft, fire, or other unexpected events that could lead to significant financial loss.

Another myth is that renters insurance is too expensive for the average renter. While the cost can vary based on location and coverage limits, many renters are surprised to learn that policies can be quite affordable, often costing less than a new pair of shoes each month. Additionally, the peace of mind that comes from having coverage is invaluable. It’s crucial for renters to weigh the minimal cost against the potential financial devastation that can arise from unforeseen accidents, making renters insurance not just a smart choice but a vital one for responsible living.